“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Restaurant Brands International Inc (NYSE:QSR) in order to identify whether reputable and successful top money managers continue to believe in its potential.

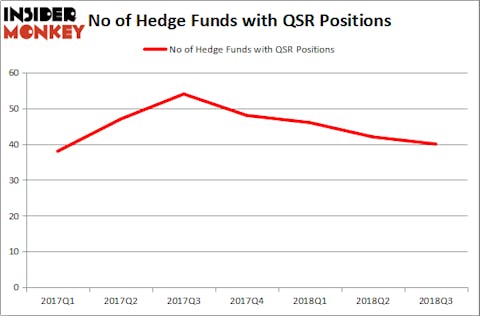

Hedge fund ownership of Restaurant Brands International Inc (NYSE:QSR) dropped for the 4th-straight quarter during Q3, as there was a small decrease in the number of funds owning the stock according to the latest 13F filings. Nonetheless, hedge funds remain bullish on the company overall, owning 25.7% of its shares. One of the company’s biggest bulls is billionaire Bill Ackman, whose fund Pershing Square owns a $1.24 billion position in QSR as of September 30, its largest holding. Ackman believes the company is executing well, even if the market has yet to realize it.

“Despite the stock’s performance, overall results remain strong, as free cash flow per share growth has increased more than 30% this year due to a combination of positive same-store stores growth, strong net unit growth and a substantial benefit from last year’s refinancing of high-cost preferred stock,” Ackman wrote in Pershing Square’s Q3 investor letter.

We’ve uncovered a reliable way to consistently beat the market by using these 13F filings and investing in only the top consensus picks of the 100 best performing hedge funds each quarter. Insider Monkey’s flagship “Best Performing Hedge Funds Strategy” has returned 96.9% since its 2014 inception (through November 2), beating the market by over 40 percentage points. Check out a detailed analysis of Insider Monkey’s performance and past quarterly stock picks for all the details. Our newest picks will be released later this month; don’t miss out!

Hedge fund activity in Restaurant Brands International Inc (NYSE:QSR)

At the end of the third quarter, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 5% dip from one quarter earlier. By comparison, 54 hedge funds held shares or bullish call options in QSR at the end of Q3 2017. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Bill Ackman’s Pershing Square held the most valuable stake in Restaurant Brands International Inc (NYSE:QSR), which was worth $1.24 billion at the end of the third quarter. On the second spot was Berkshire Hathaway which amassed $500.2 million worth of shares. Moreover, Citadel Investment Group, Suvretta Capital Management, and Hound Partners were also bullish on Restaurant Brands International Inc (NYSE:QSR), allocating a large percentage of their portfolios to this stock.

Seeing as Restaurant Brands International Inc (NYSE:QSR) has witnessed falling interest from the aggregate hedge fund industry, we can see that there is a sect of hedge funds who sold off their positions entirely last quarter. It’s worth mentioning that Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management said goodbye to the largest investment of all the hedgies followed by Insider Monkey, worth close to $123 million in call options, and Jeff Lignelli’s Incline Global Management was right behind this move, as the fund dumped about $52.4 million worth. These moves are important to note, as aggregate hedge fund interest fell by 2 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Restaurant Brands International Inc (NYSE:QSR) but similarly valued. These stocks are Avangrid, Inc. (NYSE:AGR), Quest Diagnostics Incorporated (NYSE:DGX), Vulcan Materials Company (NYSE:VMC), and Incyte Corporation (NASDAQ:INCY). This group of stocks’ market valuations are similar to QSR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AGR | 18 | 293195 | 2 |

| DGX | 38 | 649415 | 9 |

| VMC | 35 | 1338856 | 1 |

| INCY | 37 | 3254536 | 0 |

As you can see these stocks had an average of 32 hedge funds with bullish positions and the average amount invested in these stocks was $1.38 billion. That figure was $3.83 billion in QSR’s case. Quest Diagnostics Inc (NYSE:DGX) is the most popular stock in this table. On the other hand Avangrid, Inc. (NYSE:AGR) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Restaurant Brands International Inc (NYSE:QSR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.