At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

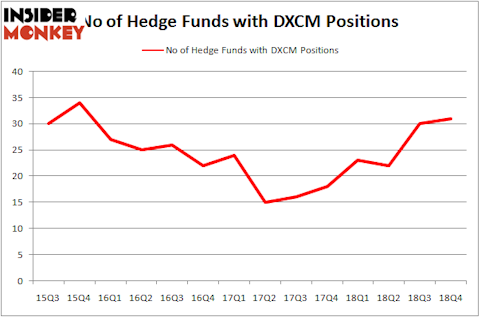

Is DexCom, Inc. (NASDAQ:DXCM) the right pick for your portfolio? The best stock pickers are in a bullish mood. The number of long hedge fund positions advanced by 1 lately. Hedge fund sentiment towards DXCM is at its highest level since 2015. This is usually a bullish indicator. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed a similar performance from Progressive Corporation (PGR) which returned 27% and MSCI which returned 29%. Both stocks outperformed the S&P 500 Index by 14 and 16 percentage points respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL, MTB and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s view the new hedge fund action regarding DexCom, Inc. (NASDAQ:DXCM).

Hedge fund activity in DexCom, Inc. (NASDAQ:DXCM)

At the end of the fourth quarter, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 3% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DXCM over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in DexCom, Inc. (NASDAQ:DXCM). Renaissance Technologies has a $116.8 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is John Overdeck and David Siegel of Two Sigma Advisors, with a $83.2 million position; 0.2% of its 13F portfolio is allocated to the stock. Other professional money managers with similar optimism comprise Columbus Circle Investors, Israel Englander’s Millennium Management and D. E. Shaw’s D E Shaw.

As aggregate interest increased, specific money managers have been driving this bullishness. OrbiMed Advisors, managed by Samuel Isaly, assembled the biggest position in DexCom, Inc. (NASDAQ:DXCM). OrbiMed Advisors had $16.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $14 million position during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, Louis Navellier’s Navellier & Associates, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as DexCom, Inc. (NASDAQ:DXCM) but similarly valued. We will take a look at Marvell Technology Group Ltd. (NASDAQ:MRVL), The J.M. Smucker Company (NYSE:SJM), Devon Energy Corp (NYSE:DVN), and TransUnion (NYSE:TRU). This group of stocks’ market caps are closest to DXCM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MRVL | 35 | 1328538 | 4 |

| SJM | 20 | 272592 | -6 |

| DVN | 42 | 1168927 | -5 |

| TRU | 28 | 1373120 | -1 |

| Average | 31.25 | 1035794 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $1036 million. That figure was $738 million in DXCM’s case. Devon Energy Corp (NYSE:DVN) is the most popular stock in this table. On the other hand The J.M. Smucker Company (NYSE:SJM) is the least popular one with only 20 bullish hedge fund positions. DexCom, Inc. (NASDAQ:DXCM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on DXCM as the stock returned 26% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.