Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of The Brink’s Company (NYSE:BCO) and see how the stock is affected by the recent hedge fund activity.

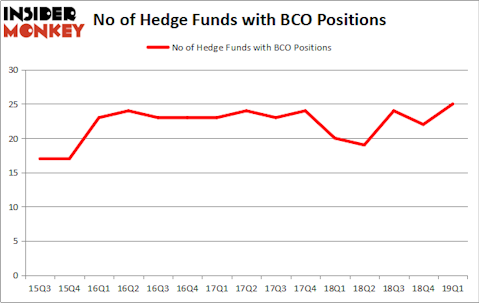

The Brink’s Company (NYSE:BCO) investors should be aware of an increase in hedge fund interest lately. Overall hedge fund sentiment towards BCO is now at its all time high. This is usually a bullish indicator. We observed this in other stocks like Roku, Uniqure, Avalara, and Disney. Roku returned returned 45%, Uniqure and Avalara delivered a 30% gain each, and Disney outperformed the market by 23 percentage points in Q2.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a peek at the fresh hedge fund action surrounding The Brink’s Company (NYSE:BCO).

What does smart money think about The Brink’s Company (NYSE:BCO)?

At Q1’s end, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from one quarter earlier. By comparison, 20 hedge funds held shares or bullish call options in BCO a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The Brink’s Company (NYSE:BCO) was held by P2 Capital Partners, which reported holding $150.2 million worth of stock at the end of March. It was followed by Deccan Value Advisors with a $128.2 million position. Other investors bullish on the company included Brahman Capital, Park West Asset Management, and Ariel Investments.

Now, key money managers have jumped into The Brink’s Company (NYSE:BCO) headfirst. Kerrisdale Capital, managed by Sahm Adrangi, created the most outsized position in The Brink’s Company (NYSE:BCO). Kerrisdale Capital had $14.2 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also initiated a $2.9 million position during the quarter. The other funds with brand new BCO positions are Joel Greenblatt’s Gotham Asset Management, Matthew Tewksbury’s Stevens Capital Management, and Ray Dalio’s Bridgewater Associates.

Let’s now review hedge fund activity in other stocks similar to The Brink’s Company (NYSE:BCO). We will take a look at Selective Insurance Group, Inc. (NASDAQ:SIGI), LiveRamp Holdings, Inc. (NYSE:RAMP), Bank OZK (NASDAQ:OZK), and Enstar Group Ltd. (NASDAQ:ESGR). This group of stocks’ market valuations resemble BCO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIGI | 12 | 28810 | -2 |

| RAMP | 23 | 323059 | 5 |

| OZK | 20 | 256803 | 2 |

| ESGR | 11 | 348751 | 2 |

| Average | 16.5 | 239356 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $239 million. That figure was $491 million in BCO’s case. LiveRamp Holdings, Inc. (NYSE:RAMP) is the most popular stock in this table. On the other hand Enstar Group Ltd. (NASDAQ:ESGR) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks The Brink’s Company (NYSE:BCO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on BCO as the stock returned 9.8% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.