Does Roku, Inc. (NASDAQ:ROKU) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

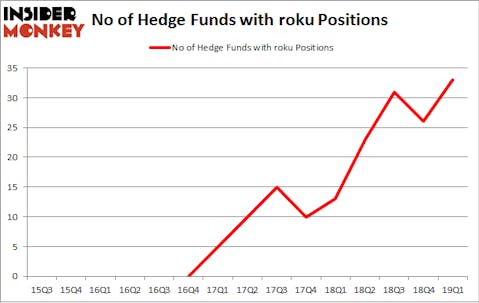

Roku, Inc. (NASDAQ:ROKU) was in 33 hedge funds’ portfolios at the end of the first quarter of 2019. ROKU has experienced an increase in enthusiasm from smart money in recent months. There were 26 hedge funds in our database with ROKU positions at the end of the previous quarter. Our calculations also showed that roku isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the key hedge fund action regarding Roku, Inc. (NASDAQ:ROKU).

What does the smart money think about Roku, Inc. (NASDAQ:ROKU)?

Heading into the second quarter of 2019, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ROKU over the last 15 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Roku, Inc. (NASDAQ:ROKU), with a stake worth $184.2 million reported as of the end of March. Trailing Renaissance Technologies was Whale Rock Capital Management, which amassed a stake valued at $134.3 million. Citadel Investment Group, Alkeon Capital Management, and Buckingham Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers have jumped into Roku, Inc. (NASDAQ:ROKU) headfirst. Renaissance Technologies, managed by Jim Simons, established the most valuable position in Roku, Inc. (NASDAQ:ROKU). Renaissance Technologies had $184.2 million invested in the company at the end of the quarter. Alex Sacerdote’s Whale Rock Capital Management also initiated a $134.3 million position during the quarter. The other funds with brand new ROKU positions are Robert Bishop’s Impala Asset Management, Peter S. Park’s Park West Asset Management, and Zach Schreiber’s Point State Capital.

Let’s also examine hedge fund activity in other stocks similar to Roku, Inc. (NASDAQ:ROKU). We will take a look at Cimarex Energy Co (NYSE:XEC), Hill-Rom Holdings, Inc. (NYSE:HRC), Signature Bank (NASDAQ:SBNY), and Medical Properties Trust, Inc. (NYSE:MPW). This group of stocks’ market values are similar to ROKU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XEC | 30 | 1100137 | 2 |

| HRC | 29 | 621941 | 0 |

| SBNY | 36 | 649446 | 0 |

| MPW | 13 | 220718 | -3 |

| Average | 27 | 648061 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $648 million. That figure was $505 million in ROKU’s case. Signature Bank (NASDAQ:SBNY) is the most popular stock in this table. On the other hand Medical Properties Trust, Inc. (NYSE:MPW) is the least popular one with only 13 bullish hedge fund positions. Roku, Inc. (NASDAQ:ROKU) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ROKU as the stock returned 44.7% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.