Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. NASDAQ and Russell 2000 indices were already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points in the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Royal Caribbean Cruises Ltd. (NYSE:RCL).

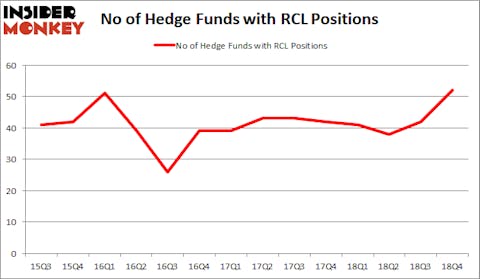

Royal Caribbean Cruises Ltd. (NYSE:RCL) has experienced an increase in enthusiasm from smart money in recent months. RCL was in 52 hedge funds’ portfolios at the end of December. There were 42 hedge funds in our database with RCL positions at the end of the previous quarter. Hedge fund sentiment towards Royal Caribbean Cruises currently sits at its all time high. This is usually a very bullish signal. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed a similar performance from Progressive Corporation (PGR) which returned 27% and outperformed the SPY by nearly 14 percentage points in 2.5 months. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM) and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a gander at the latest hedge fund action encompassing Royal Caribbean Cruises Ltd. (NYSE:RCL).

What have hedge funds been doing with Royal Caribbean Cruises Ltd. (NYSE:RCL)?

Heading into the first quarter of 2019, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a change of 24% from one quarter earlier. On the other hand, there were a total of 41 hedge funds with a bullish position in RCL a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Royal Caribbean Cruises Ltd. (NYSE:RCL), with a stake worth $183.9 million reported as of the end of September. Trailing Citadel Investment Group was Eminence Capital, which amassed a stake valued at $159.9 million. D E Shaw, Highline Capital Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, some big names were leading the bulls’ herd. Eminence Capital, managed by Ricky Sandler, created the most outsized position in Royal Caribbean Cruises Ltd. (NYSE:RCL). Eminence Capital had $159.9 million invested in the company at the end of the quarter. Gregg Moskowitz’s Interval Partners also initiated a $47.9 million position during the quarter. The other funds with brand new RCL positions are Aaron Cowen’s Suvretta Capital Management, Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital, and Mark Kingdon’s Kingdon Capital.

Let’s check out hedge fund activity in other stocks similar to Royal Caribbean Cruises Ltd. (NYSE:RCL). These stocks are Spotify Technology S.A. (NYSE:SPOT), PPL Corporation (NYSE:PPL), Telefonica Brasil SA (NYSE:VIV), and M&T Bank Corporation (NYSE:MTB). This group of stocks’ market caps match RCL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPOT | 45 | 2877833 | -22 |

| PPL | 23 | 798188 | -1 |

| VIV | 12 | 151235 | -1 |

| MTB | 42 | 1495917 | 1 |

| Average | 30.5 | 1330793 | -5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.5 hedge funds with bullish positions and the average amount invested in these stocks was $1331 million. That figure was $1579 million in RCL’s case. Spotify Technology S.A. (NYSE:SPOT) is the most popular stock in this table. On the other hand Telefonica Brasil SA (NYSE:VIV) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Royal Caribbean Cruises Ltd. (NYSE:RCL) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Similar to Xilinx, Inc. (NASDAQ:XLNX), IQVIA Holdings, Inc. (NYSE:IQV), Brookfield Asset Management Inc. (NYSE:BAM), and Atlassian Corporation Plc (NASDAQ:TEAM) where hedge fund sentiment is at an all time high, Royal Caribbean Cruises also returned more than 20% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.