After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards NVR, Inc. (NYSE:NVR).

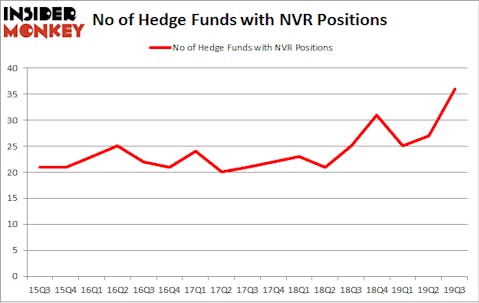

NVR, Inc. (NYSE:NVR) was in 36 hedge funds’ portfolios at the end of the third quarter of 2019. NVR investors should be aware of an increase in enthusiasm from smart money in recent months. There were 27 hedge funds in our database with NVR holdings at the end of the previous quarter. Our calculations also showed that NVR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are dozens of metrics stock traders employ to grade publicly traded companies. A pair of the best metrics are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the top fund managers can outperform their index-focused peers by a superb margin (see the details here).

Noam Gottesman of GLG Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s check out the latest hedge fund action regarding NVR, Inc. (NYSE:NVR).

Hedge fund activity in NVR, Inc. (NYSE:NVR)

Heading into the fourth quarter of 2019, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards NVR over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the largest position in NVR, Inc. (NYSE:NVR), worth close to $357.6 million, accounting for 1.9% of its total 13F portfolio. Sitting at the No. 2 spot is Impala Asset Management, led by Robert Bishop, holding a $136.2 million position; 9.8% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors with similar optimism encompass Renaissance Technologies, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Impala Asset Management allocated the biggest weight to NVR, Inc. (NYSE:NVR), around 9.85% of its portfolio. Giverny Capital is also relatively very bullish on the stock, earmarking 5.36 percent of its 13F equity portfolio to NVR.

Consequently, key hedge funds were breaking ground themselves. Adage Capital Management, managed by Phill Gross and Robert Atchinson, created the biggest position in NVR, Inc. (NYSE:NVR). Adage Capital Management had $16 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace also initiated a $12.4 million position during the quarter. The following funds were also among the new NVR investors: Louis Bacon’s Moore Global Investments, Paul Tudor Jones’s Tudor Investment Corp, and Matthew Tewksbury’s Stevens Capital Management.

Let’s now review hedge fund activity in other stocks similar to NVR, Inc. (NYSE:NVR). These stocks are Wabtec Corporation (NYSE:WAB), Hologic, Inc. (NASDAQ:HOLX), Sun Communities Inc (NYSE:SUI), and Atmos Energy Corporation (NYSE:ATO). This group of stocks’ market caps are closest to NVR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAB | 32 | 1646949 | 5 |

| HOLX | 33 | 1018180 | 1 |

| SUI | 15 | 303237 | -5 |

| ATO | 19 | 407896 | 5 |

| Average | 24.75 | 844066 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $844 million. That figure was $1163 million in NVR’s case. Hologic, Inc. (NASDAQ:HOLX) is the most popular stock in this table. On the other hand Sun Communities Inc (NYSE:SUI) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks NVR, Inc. (NYSE:NVR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately NVR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NVR were disappointed as the stock returned 2% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.