At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of June 28. In this article, we will use that wealth of knowledge to determine whether or not NVR, Inc. (NYSE:NVR) makes for a good investment right now.

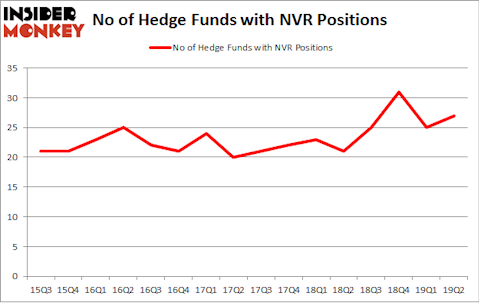

NVR, Inc. (NYSE:NVR) shareholders have witnessed an increase in hedge fund sentiment in recent months. NVR was in 27 hedge funds’ portfolios at the end of the second quarter of 2019. There were 25 hedge funds in our database with NVR holdings at the end of the previous quarter. Our calculations also showed that NVR isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are assumed to be slow, old financial vehicles of the past. While there are more than 8000 funds with their doors open at the moment, We look at the masters of this group, approximately 750 funds. These hedge fund managers oversee bulk of all hedge funds’ total capital, and by following their inimitable equity investments, Insider Monkey has unsheathed many investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the fresh hedge fund action encompassing NVR, Inc. (NYSE:NVR).

Hedge fund activity in NVR, Inc. (NYSE:NVR)

Heading into the third quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NVR over the last 16 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Diamond Hill Capital, managed by Ric Dillon, holds the largest position in NVR, Inc. (NYSE:NVR). Diamond Hill Capital has a $356.7 million position in the stock, comprising 1.9% of its 13F portfolio. The second largest stake is held by Impala Asset Management, managed by Robert Bishop, which holds a $132.2 million position; 6% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions contain Renaissance Technologies, John Overdeck and David Siegel’s Two Sigma Advisors and Noam Gottesman’s GLG Partners.

As one would reasonably expect, some big names were leading the bulls’ herd. Capital Growth Management, managed by Ken Heebner, initiated the most outsized position in NVR, Inc. (NYSE:NVR). Capital Growth Management had $49.9 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $36.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Michael Gelband’s ExodusPoint Capital, Ray Dalio’s Bridgewater Associates, and Andre F. Perold’s HighVista Strategies.

Let’s check out hedge fund activity in other stocks similar to NVR, Inc. (NYSE:NVR). These stocks are Centrais Eletricas Brasileiras S.A. – Eletrobras (NYSE:EBR), BanColombia S.A. (NYSE:CIB), Brookfield Infrastructure Partners L.P. (NYSE:BIP), and Molson Coors Brewing Company (NYSE:TAP). All of these stocks’ market caps match NVR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EBR | 6 | 23900 | -2 |

| CIB | 10 | 159266 | -1 |

| BIP | 7 | 44941 | 0 |

| TAP | 25 | 451878 | -2 |

| Average | 12 | 169996 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $972 million in NVR’s case. Molson Coors Brewing Company (NYSE:TAP) is the most popular stock in this table. On the other hand Centrais Eletricas Brasileiras S.A. – Eletrobras (NYSE:EBR) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks NVR, Inc. (NYSE:NVR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks (view the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on NVR as the stock returned 10.3% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.