Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Fluidigm Corporation (NASDAQ:FLDM)? The smart money sentiment can provide an answer to this question.

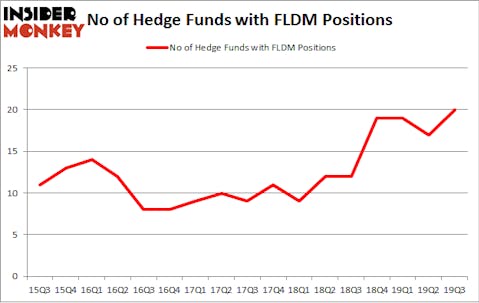

Fluidigm Corporation (NASDAQ:FLDM) investors should be aware of an increase in enthusiasm from smart money of late. FLDM was in 20 hedge funds’ portfolios at the end of the third quarter of 2019. There were 17 hedge funds in our database with FLDM positions at the end of the previous quarter. Our calculations also showed that FLDM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Richard Driehaus of Driehaus Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the key hedge fund action encompassing Fluidigm Corporation (NASDAQ:FLDM).

Hedge fund activity in Fluidigm Corporation (NASDAQ:FLDM)

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FLDM over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Fluidigm Corporation (NASDAQ:FLDM) was held by Levin Easterly Partners, which reported holding $23.2 million worth of stock at the end of September. It was followed by Partner Fund Management with a $14.4 million position. Other investors bullish on the company included Renaissance Technologies, Indaba Capital Management, and Driehaus Capital. In terms of the portfolio weights assigned to each position Indaba Capital Management allocated the biggest weight to Fluidigm Corporation (NASDAQ:FLDM), around 2.94% of its 13F portfolio. Pura Vida Investments is also relatively very bullish on the stock, designating 0.81 percent of its 13F equity portfolio to FLDM.

As aggregate interest increased, key money managers have been driving this bullishness. Indaba Capital Management, managed by Derek C. Schrier, created the largest position in Fluidigm Corporation (NASDAQ:FLDM). Indaba Capital Management had $12.6 million invested in the company at the end of the quarter. Vishal Saluja and Pham Quang’s Endurant Capital Management also initiated a $1.8 million position during the quarter. The following funds were also among the new FLDM investors: Andrew Weiss’s Weiss Asset Management, Efrem Kamen’s Pura Vida Investments, and Mike Vranos’s Ellington.

Let’s now review hedge fund activity in other stocks similar to Fluidigm Corporation (NASDAQ:FLDM). We will take a look at Summit Financial Group, Inc. (NASDAQ:SMMF), CASI Pharmaceuticals Inc (NASDAQ:CASI), resTORbio, Inc. (NASDAQ:TORC), and Steel Partners Holdings LP (NYSE:SPLP). This group of stocks’ market caps resemble FLDM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SMMF | 2 | 7717 | 0 |

| CASI | 2 | 282 | 1 |

| TORC | 4 | 53231 | 1 |

| SPLP | 5 | 27638 | 0 |

| Average | 3.25 | 22217 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.25 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $90 million in FLDM’s case. Steel Partners Holdings LP (NYSE:SPLP) is the most popular stock in this table. On the other hand Summit Financial Group, Inc. (NASDAQ:SMMF) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Fluidigm Corporation (NASDAQ:FLDM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately FLDM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FLDM were disappointed as the stock returned -45.6% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.