How do we determine whether Canadian National Railway Company (NYSE:CNI) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

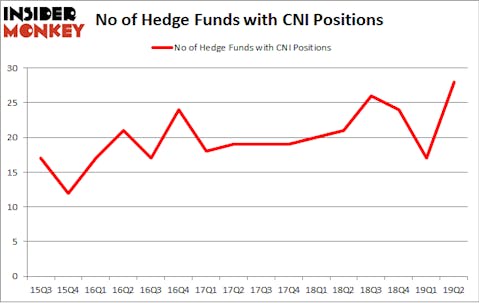

Canadian National Railway Company (NYSE:CNI) investors should be aware of an increase in activity from the world’s largest hedge funds lately. CNI was in 28 hedge funds’ portfolios at the end of the second quarter of 2019. There were 17 hedge funds in our database with CNI holdings at the end of the previous quarter. Our calculations also showed that CNI isn’t among the 30 most popular stocks among hedge funds (see the video at the bottom of this article).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the new hedge fund action encompassing Canadian National Railway Company (NYSE:CNI).

What does smart money think about Canadian National Railway Company (NYSE:CNI)?

At the end of the second quarter, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 65% from the first quarter of 2019. On the other hand, there were a total of 21 hedge funds with a bullish position in CNI a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Bill & Melinda Gates Foundation Trust was the largest shareholder of Canadian National Railway Company (NYSE:CNI), with a stake worth $1583.9 million reported as of the end of March. Trailing Bill & Melinda Gates Foundation Trust was Arrowstreet Capital, which amassed a stake valued at $451 million. Renaissance Technologies, Millennium Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, some big names were leading the bulls’ herd. Millennium Management, managed by Israel Englander, established the largest position in Canadian National Railway Company (NYSE:CNI). Millennium Management had $44.8 million invested in the company at the end of the quarter. Todd J. Kantor’s Encompass Capital Advisors also initiated a $9.3 million position during the quarter. The following funds were also among the new CNI investors: Sara Nainzadeh’s Centenus Global Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Charles Davidson and Joseph Jacobs’s Wexford Capital.

Let’s go over hedge fund activity in other stocks similar to Canadian National Railway Company (NYSE:CNI). These stocks are Chubb Limited (NYSE:CB), ConocoPhillips (NYSE:COP), Westpac Banking Corporation (NYSE:WBK), and Sony Corporation (NYSE:SNE). This group of stocks’ market caps resemble CNI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CB | 25 | 501768 | 2 |

| COP | 57 | 3405838 | 3 |

| WBK | 3 | 37127 | -3 |

| SNE | 35 | 1036064 | 13 |

| Average | 30 | 1245199 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $1245 million. That figure was $2304 million in CNI’s case. ConocoPhillips (NYSE:COP) is the most popular stock in this table. On the other hand Westpac Banking Corporation (NYSE:WBK) is the least popular one with only 3 bullish hedge fund positions. Canadian National Railway Company (NYSE:CNI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CNI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); CNI investors were disappointed as the stock returned -2.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.