Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Canadian National Railway Company (NYSE:CNI).

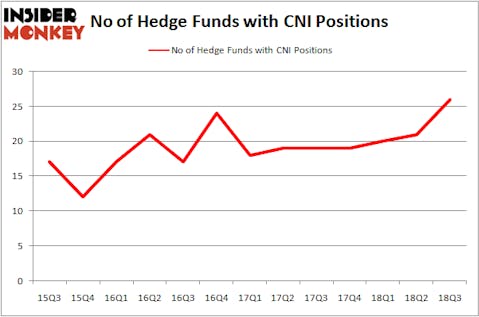

Canadian National Railway Company (NYSE:CNI) was in 26 hedge funds’ portfolios at the end of September. CNI has experienced an increase in hedge fund interest lately. There were 21 hedge funds in our database with CNI holdings at the end of the previous quarter. Our calculations also showed that CNI isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action regarding Canadian National Railway Company (NYSE:CNI).

What have hedge funds been doing with Canadian National Railway Company (NYSE:CNI)?

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 24% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CNI over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Bill & Melinda Gates Foundation Trust, managed by Michael Larson, holds the number one position in Canadian National Railway Company (NYSE:CNI). Bill & Melinda Gates Foundation Trust has a $1.538 billion position in the stock, comprising 6% of its 13F portfolio. On Bill & Melinda Gates Foundation Trust’s heels is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $828.4 million position; 1.9% of its 13F portfolio is allocated to the company. Remaining peers that are bullish consist of Jim Simons’s Renaissance Technologies, Cliff Asness’s AQR Capital Management and Ray Dalio’s Bridgewater Associates.

Consequently, some big names have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, established the largest position in Canadian National Railway Company (NYSE:CNI). Point72 Asset Management had $29.9 million invested in the company at the end of the quarter. Greg Poole’s Echo Street Capital Management also made a $10.8 million investment in the stock during the quarter. The other funds with brand new CNI positions are John Overdeck and David Siegel’s Two Sigma Advisors, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s go over hedge fund activity in other stocks similar to Canadian National Railway Company (NYSE:CNI). These stocks are Intuitive Surgical, Inc. (NASDAQ:ISRG), Allergan plc (NYSE:AGN), China Life Insurance Company Ltd. (NYSE:LFC), and American Tower Corporation (REIT) (NYSE:AMT). All of these stocks’ market caps match CNI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ISRG | 44 | 2247916 | -1 |

| AGN | 62 | 5149613 | 4 |

| LFC | 10 | 53288 | 0 |

| AMT | 42 | 2904624 | 3 |

| Average | 39.5 | 2588860 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.5 hedge funds with bullish positions and the average amount invested in these stocks was $2.59 billion. That figure was $2.63 billion in CNI’s case. Allergan plc (NYSE:AGN) is the most popular stock in this table. On the other hand China Life Insurance Company Ltd. (NYSE:LFC) is the least popular one with only 10 bullish hedge fund positions. Canadian National Railway Company (NYSE:CNI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AGN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.