It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Victory Capital Holdings, Inc. (NASDAQ:VCTR).

Victory Capital Holdings, Inc. (NASDAQ:VCTR) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged and stood at its all time high that was achieved at the end of September. The stock was in 10 hedge funds’ portfolios at the end of December. This is usually a very bullish indicator. For example hedge fund positions in Xerox jumped to its all time high by the end of December and the stock returned more than 72% in the following 3 months or so. Another example is Trade Desk Inc. Hedge fund sentiment towards the stock was also at its all time high at the beginning of this year and the stock returned more than 81% in 3.5 months. Similarly Xilinx, Alteryx and EEFT returned more than 40% after hedge fund sentiment hit its all time high at the end of December. We observed similar performances from OKTA, Twilio, EGOV, CCK, MSCI, and MASI; these stocks returned 37%, 37%, 36%, 35%, 29%, and 28% respectively. There were actually more than 500 stocks that hit all time highs in terms of hedge fund sentiment at the end of December. These stocks delivered an average gain of 22.2% in 2019 through April 25th and outperformed the S&P 500 Index by about 5 percentage points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Paul Marshall of Marshall Wace

We’re going to take a look at the fresh hedge fund action surrounding Victory Capital Holdings, Inc. (NASDAQ:VCTR).

How have hedgies been trading Victory Capital Holdings, Inc. (NASDAQ:VCTR)?

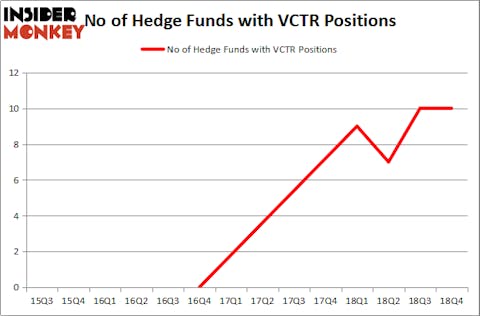

At the end of the fourth quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VCTR over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Impax Asset Management held the most valuable stake in Victory Capital Holdings, Inc. (NASDAQ:VCTR), which was worth $16.2 million at the end of the third quarter. On the second spot was Azora Capital which amassed $8.1 million worth of shares. Moreover, Marshall Wace LLP, Renaissance Technologies, and BlueMar Capital Management were also bullish on Victory Capital Holdings, Inc. (NASDAQ:VCTR), allocating a large percentage of their portfolios to this stock.

Due to the fact that Victory Capital Holdings, Inc. (NASDAQ:VCTR) has faced bearish sentiment from the entirety of the hedge funds we track, we can see that there exists a select few money managers that elected to cut their positions entirely last quarter. Interestingly, Anand Parekh’s Alyeska Investment Group dropped the biggest investment of all the hedgies watched by Insider Monkey, worth close to $6.9 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also dumped its stock, about $0.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Victory Capital Holdings, Inc. (NASDAQ:VCTR) but similarly valued. These stocks are Hersha Hospitality Trust (NYSE:HT), Sohu.com Limited (NASDAQ:SOHU), Cerus Corporation (NASDAQ:CERS), and Astec Industries, Inc. (NASDAQ:ASTE). All of these stocks’ market caps match VCTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HT | 13 | 36672 | 5 |

| SOHU | 10 | 93208 | -1 |

| CERS | 15 | 90900 | -3 |

| ASTE | 10 | 75982 | 0 |

| Average | 12 | 74191 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $42 million in VCTR’s case. Cerus Corporation (NASDAQ:CERS) is the most popular stock in this table. On the other hand Sohu.com Limited (NASDAQ:SOHU) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Victory Capital Holdings, Inc. (NASDAQ:VCTR) is even less popular than SOHU. Hedge funds clearly dropped the ball on VCTR as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on VCTR as the stock returned 49.1% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.