Is Alector, Inc. (NASDAQ:ALEC) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

Hedge fund interest in Alector, Inc. (NASDAQ:ALEC) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare ALEC to other stocks including Callon Petroleum Company (NYSE:CPE), Kadant Inc. (NYSE:KAI), and ARMOUR Residential REIT, Inc. (NYSE:ARR) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are plenty of signals investors can use to assess stocks. A pair of the less utilized signals are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the best money managers can trounce the broader indices by a significant margin (see the details here).

Peter Kolchinsky of RA Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to review the fresh hedge fund action regarding Alector, Inc. (NASDAQ:ALEC).

What does smart money think about Alector, Inc. (NASDAQ:ALEC)?

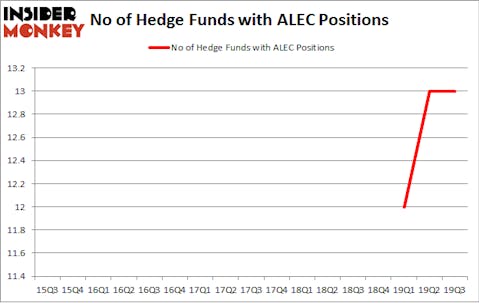

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in ALEC over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Samuel Isaly’s OrbiMed Advisors has the number one position in Alector, Inc. (NASDAQ:ALEC), worth close to $180.7 million, corresponding to 3.4% of its total 13F portfolio. Coming in second is Deerfield Management, led by James E. Flynn, holding a $29.9 million position; 1.2% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish consist of Peter Kolchinsky’s RA Capital Management, Eli Casdin’s Casdin Capital and Joseph Edelman’s Perceptive Advisors. In terms of the portfolio weights assigned to each position OrbiMed Advisors allocated the biggest weight to Alector, Inc. (NASDAQ:ALEC), around 3.43% of its 13F portfolio. Deerfield Management is also relatively very bullish on the stock, earmarking 1.22 percent of its 13F equity portfolio to ALEC.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Citadel Investment Group. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Adage Capital Management).

Let’s now take a look at hedge fund activity in other stocks similar to Alector, Inc. (NASDAQ:ALEC). We will take a look at Callon Petroleum Company (NYSE:CPE), Kadant Inc. (NYSE:KAI), ARMOUR Residential REIT, Inc. (NYSE:ARR), and AtriCure Inc. (NASDAQ:ATRC). This group of stocks’ market values are similar to ALEC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPE | 28 | 383202 | 16 |

| KAI | 12 | 72191 | 1 |

| ARR | 11 | 69052 | 3 |

| ATRC | 19 | 87624 | -1 |

| Average | 17.5 | 153017 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $153 million. That figure was $259 million in ALEC’s case. Callon Petroleum Company (NYSE:CPE) is the most popular stock in this table. On the other hand ARMOUR Residential REIT, Inc. (NYSE:ARR) is the least popular one with only 11 bullish hedge fund positions. Alector, Inc. (NASDAQ:ALEC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on ALEC as the stock returned 29.3% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.