Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

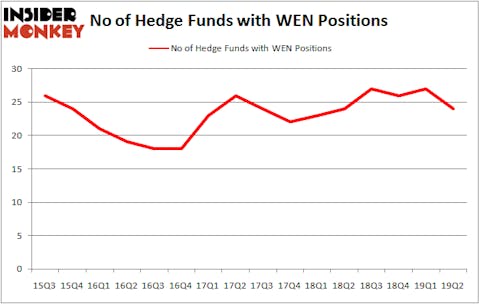

The Wendy’s Company (NASDAQ:WEN) investors should be aware of a decrease in hedge fund interest in recent months. WEN was in 24 hedge funds’ portfolios at the end of June. There were 27 hedge funds in our database with WEN holdings at the end of the previous quarter. Our calculations also showed that WEN isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the new hedge fund action encompassing The Wendy’s Company (NASDAQ:WEN).

How have hedgies been trading The Wendy’s Company (NASDAQ:WEN)?

Heading into the third quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from the first quarter of 2019. By comparison, 24 hedge funds held shares or bullish call options in WEN a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Trian Partners held the most valuable stake in The Wendy’s Company (NASDAQ:WEN), which was worth $560.6 million at the end of the second quarter. On the second spot was Cardinal Capital which amassed $52.8 million worth of shares. Moreover, Horizon Asset Management, Marshall Wace LLP, and Two Sigma Advisors were also bullish on The Wendy’s Company (NASDAQ:WEN), allocating a large percentage of their portfolios to this stock.

Since The Wendy’s Company (NASDAQ:WEN) has faced bearish sentiment from the aggregate hedge fund industry, we can see that there exists a select few hedge funds that decided to sell off their entire stakes last quarter. At the top of the heap, Aaron Cowen’s Suvretta Capital Management said goodbye to the biggest position of all the hedgies tracked by Insider Monkey, valued at close to $39.8 million in stock. Ken Griffin’s fund, Citadel Investment Group, also cut its stock, about $34.2 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to The Wendy’s Company (NASDAQ:WEN). We will take a look at Fluor Corporation (NYSE:FLR), NewMarket Corporation (NYSE:NEU), Highwoods Properties Inc (NYSE:HIW), and Foot Locker, Inc. (NYSE:FL). This group of stocks’ market values resemble WEN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLR | 21 | 286630 | -1 |

| NEU | 20 | 88622 | -1 |

| HIW | 13 | 165968 | -1 |

| FL | 32 | 592888 | -3 |

| Average | 21.5 | 283527 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $284 million. That figure was $915 million in WEN’s case. Foot Locker, Inc. (NYSE:FL) is the most popular stock in this table. On the other hand Highwoods Properties Inc (NYSE:HIW) is the least popular one with only 13 bullish hedge fund positions. The Wendy’s Company (NASDAQ:WEN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on WEN, though not to the same extent, as the stock returned 2.5% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.