Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Codexis, Inc. (NASDAQ:CDXS).

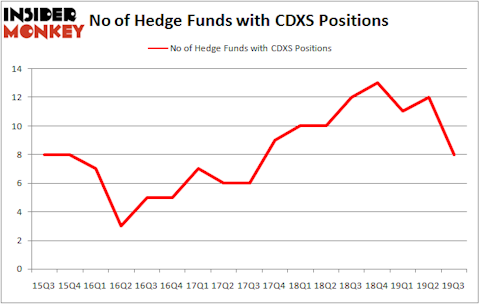

Is Codexis, Inc. (NASDAQ:CDXS) a great investment right now? Hedge funds are in a bearish mood. The number of long hedge fund bets dropped by 4 in recent months. Our calculations also showed that CDXS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). CDXS was in 8 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with CDXS positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Kamran Moghtaderi of Eversept Partners

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the recent hedge fund action surrounding Codexis, Inc. (NASDAQ:CDXS).

What have hedge funds been doing with Codexis, Inc. (NASDAQ:CDXS)?

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -33% from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in CDXS a year ago. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

More specifically, Nantahala Capital Management was the largest shareholder of Codexis, Inc. (NASDAQ:CDXS), with a stake worth $73.6 million reported as of the end of September. Trailing Nantahala Capital Management was Casdin Capital, which amassed a stake valued at $67.9 million. Vivo Capital, Opaleye Management, and Prescott Group Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Casdin Capital allocated the biggest weight to Codexis, Inc. (NASDAQ:CDXS), around 6.79% of its 13F portfolio. Opaleye Management is also relatively very bullish on the stock, designating 6.7 percent of its 13F equity portfolio to CDXS.

Due to the fact that Codexis, Inc. (NASDAQ:CDXS) has witnessed bearish sentiment from the smart money, logic holds that there lies a certain “tier” of fund managers that elected to cut their entire stakes heading into Q4. Intriguingly, Farallon Capital sold off the largest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $23 million in stock. Richard Driehaus’s fund, Driehaus Capital, also said goodbye to its stock, about $8.1 million worth. These moves are important to note, as total hedge fund interest was cut by 4 funds heading into Q4.

Let’s check out hedge fund activity in other stocks similar to Codexis, Inc. (NASDAQ:CDXS). These stocks are Preferred Bank (NASDAQ:PFBC), Seabridge Gold, Inc. (NYSE:SA), GoPro Inc (NASDAQ:GPRO), and Oritani Financial Corp. (NASDAQ:ORIT). This group of stocks’ market values resemble CDXS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PFBC | 10 | 37669 | -2 |

| SA | 6 | 39255 | -3 |

| GPRO | 16 | 181016 | -3 |

| ORIT | 8 | 43932 | 2 |

| Average | 10 | 75468 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $75 million. That figure was $207 million in CDXS’s case. GoPro Inc (NASDAQ:GPRO) is the most popular stock in this table. On the other hand Seabridge Gold, Inc. (NYSE:SA) is the least popular one with only 6 bullish hedge fund positions. Codexis, Inc. (NASDAQ:CDXS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on CDXS as the stock returned 13.3% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.