Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

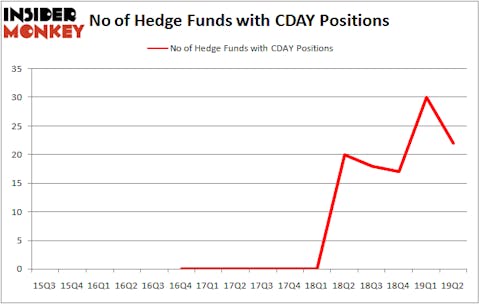

Is Ceridian HCM Holding Inc. (NYSE:CDAY) the right pick for your portfolio? Hedge funds are turning less bullish. The number of bullish hedge fund bets retreated by 8 recently. Our calculations also showed that CDAY isn’t among the 30 most popular stocks among hedge funds (see the video below). CDAY was in 22 hedge funds’ portfolios at the end of the second quarter of 2019. There were 30 hedge funds in our database with CDAY positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most investors, hedge funds are viewed as unimportant, outdated investment tools of years past. While there are more than 8000 funds in operation at present, Our researchers choose to focus on the bigwigs of this group, approximately 750 funds. These investment experts direct most of the hedge fund industry’s total capital, and by tailing their matchless picks, Insider Monkey has spotted a number of investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the key hedge fund action encompassing Ceridian HCM Holding Inc. (NYSE:CDAY).

What have hedge funds been doing with Ceridian HCM Holding Inc. (NYSE:CDAY)?

At Q2’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -27% from the first quarter of 2019. By comparison, 20 hedge funds held shares or bullish call options in CDAY a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Select Equity Group was the largest shareholder of Ceridian HCM Holding Inc. (NYSE:CDAY), with a stake worth $319.8 million reported as of the end of March. Trailing Select Equity Group was Whale Rock Capital Management, which amassed a stake valued at $169.1 million. Ashe Capital, Alkeon Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Because Ceridian HCM Holding Inc. (NYSE:CDAY) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there exists a select few funds that slashed their full holdings by the end of the second quarter. Intriguingly, George Soros’s Soros Fund Management dropped the largest position of the 750 funds watched by Insider Monkey, valued at about $84.6 million in stock. Bain Capital’s fund, Brookside Capital, also sold off its stock, about $16.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 8 funds by the end of the second quarter.

Let’s go over hedge fund activity in other stocks similar to Ceridian HCM Holding Inc. (NYSE:CDAY). These stocks are Wix.Com Ltd (NASDAQ:WIX), Unum Group (NYSE:UNM), ServiceMaster Global Holdings Inc (NYSE:SERV), and EnCana Corporation (NYSE:ECA). All of these stocks’ market caps resemble CDAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WIX | 26 | 1073011 | -1 |

| UNM | 25 | 493510 | 0 |

| SERV | 30 | 794886 | 6 |

| ECA | 32 | 464569 | -12 |

| Average | 28.25 | 706494 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $706 million. That figure was $846 million in CDAY’s case. EnCana Corporation (NYSE:ECA) is the most popular stock in this table. On the other hand Unum Group (NYSE:UNM) is the least popular one with only 25 bullish hedge fund positions. Compared to these stocks Ceridian HCM Holding Inc. (NYSE:CDAY) is even less popular than UNM. Hedge funds dodged a bullet by taking a bearish stance towards CDAY. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CDAY wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CDAY investors were disappointed as the stock returned -1.7% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.