It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 10 percentage points in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Tapestry, Inc. (NYSE:TPR).

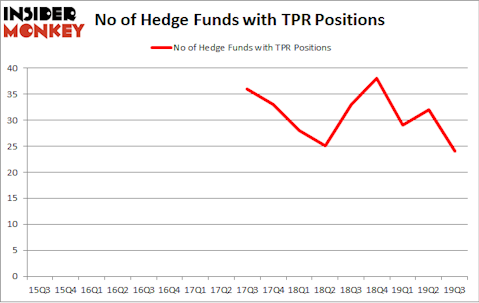

Tapestry, Inc. (NYSE:TPR) was in 24 hedge funds’ portfolios at the end of September. TPR has experienced a decrease in hedge fund interest in recent months. There were 32 hedge funds in our database with TPR positions at the end of the previous quarter. Our calculations also showed that TPR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In today’s marketplace there are many tools stock traders use to value their stock investments. A duo of the best tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the elite fund managers can beat the S&P 500 by a healthy margin (see the details here).

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind let’s check out the latest hedge fund action regarding Tapestry, Inc. (NYSE:TPR).

How have hedgies been trading Tapestry, Inc. (NYSE:TPR)?

Heading into the fourth quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -25% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in TPR over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Tapestry, Inc. (NYSE:TPR) was held by Two Sigma Advisors, which reported holding $82.8 million worth of stock at the end of September. It was followed by Alyeska Investment Group with a $48.5 million position. Other investors bullish on the company included Citadel Investment Group, D E Shaw, and Samlyn Capital. In terms of the portfolio weights assigned to each position Raging Capital Management allocated the biggest weight to Tapestry, Inc. (NYSE:TPR), around 2.71% of its 13F portfolio. Samlyn Capital is also relatively very bullish on the stock, setting aside 0.88 percent of its 13F equity portfolio to TPR.

Since Tapestry, Inc. (NYSE:TPR) has experienced bearish sentiment from hedge fund managers, logic holds that there is a sect of hedgies that elected to cut their full holdings in the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management said goodbye to the biggest position of the “upper crust” of funds tracked by Insider Monkey, totaling an estimated $23.7 million in stock. Renaissance Technologies, also cut its stock, about $20 million worth. These moves are interesting, as aggregate hedge fund interest fell by 8 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Tapestry, Inc. (NYSE:TPR) but similarly valued. These stocks are James Hardie Industries plc (NYSE:JHX), BRF S.A. (NYSE:BRFS), Bio-Techne Corporation (NASDAQ:TECH), and Peloton Interactive, Inc. (NASDAQ:PTON). This group of stocks’ market caps resemble TPR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JHX | 2 | 6880 | 0 |

| BRFS | 14 | 116226 | 1 |

| TECH | 19 | 317814 | -5 |

| PTON | 27 | 450294 | 27 |

| Average | 15.5 | 222804 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $223 million. That figure was $385 million in TPR’s case. Peloton Interactive, Inc. (NASDAQ:PTON) is the most popular stock in this table. On the other hand James Hardie Industries plc (NYSE:JHX) is the least popular one with only 2 bullish hedge fund positions. Tapestry, Inc. (NYSE:TPR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately TPR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TPR were disappointed as the stock returned -16% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.