The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Tapestry, Inc. (NYSE:TPR) from the perspective of those elite funds.

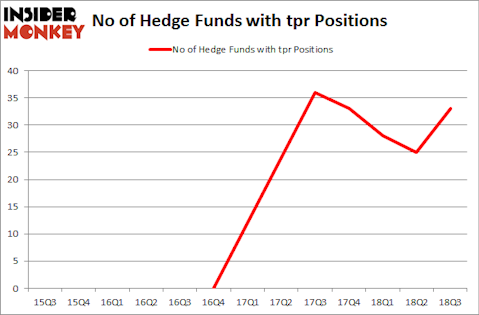

Tapestry, Inc. (NYSE:TPR) shareholders have witnessed an increase in hedge fund interest of late. Our calculations also showed that tpr isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to view the new hedge fund action surrounding Tapestry, Inc. (NYSE:TPR).

What does the smart money think about Tapestry, Inc. (NYSE:TPR)?

At Q3’s end, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 32% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards TPR over the last 13 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in Tapestry, Inc. (NYSE:TPR), worth close to $247.9 million, corresponding to 0.3% of its total 13F portfolio. The second most bullish fund manager is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $85.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions include Israel Englander’s Millennium Management, Steve Cohen’s Point72 Asset Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

As one would reasonably expect, some big names have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, established the largest position in Tapestry, Inc. (NYSE:TPR). Point72 Asset Management had $56.5 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $53.9 million position during the quarter. The following funds were also among the new TPR investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Gregg Moskowitz’s Interval Partners, and Jeffrey Talpins’s Element Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Tapestry, Inc. (NYSE:TPR). These stocks are XPO Logistics Inc (NYSE:XPO), The Liberty SiriusXM Group (NASDAQ:LSXMA), Gartner Inc (NYSE:IT), and Godaddy Inc (NYSE:GDDY). This group of stocks’ market valuations match TPR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XPO | 44 | 3385038 | -3 |

| LSXMA | 39 | 1604271 | 1 |

| IT | 13 | 1271736 | -8 |

| GDDY | 48 | 3169488 | 6 |

| Average | 36 | 2357633 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36 hedge funds with bullish positions and the average amount invested in these stocks was $2.36 billion. That figure was $863 million in TPR’s case. Godaddy Inc (NYSE:GDDY) is the most popular stock in this table. On the other hand Gartner Inc (NYSE:IT) is the least popular one with only 13 bullish hedge fund positions. Tapestry, Inc. (NYSE:TPR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GDDY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.