Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Nutanix, Inc. (NASDAQ:NTNX), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

Nutanix, Inc. (NASDAQ:NTNX) shareholders have witnessed a decrease in hedge fund interest of late. Our calculations also showed that NTNX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are dozens of gauges market participants put to use to analyze stocks. A couple of the most useful gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outclass the S&P 500 by a solid amount (see the details here).

Ricky Sandler of Eminence Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a glance at the recent hedge fund action regarding Nutanix, Inc. (NASDAQ:NTNX).

How are hedge funds trading Nutanix, Inc. (NASDAQ:NTNX)?

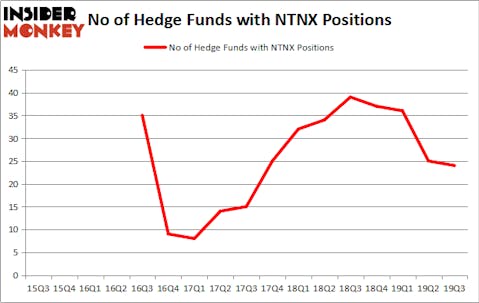

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in NTNX over the last 17 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in Nutanix, Inc. (NASDAQ:NTNX) was held by Eminence Capital, which reported holding $141.7 million worth of stock at the end of September. It was followed by Millennium Management with a $30.5 million position. Other investors bullish on the company included Isomer Partners, Altimeter Capital Management, and Citadel Investment Group. In terms of the portfolio weights assigned to each position Isomer Partners allocated the biggest weight to Nutanix, Inc. (NASDAQ:NTNX), around 8.48% of its 13F portfolio. Kerrisdale Capital is also relatively very bullish on the stock, dishing out 2.61 percent of its 13F equity portfolio to NTNX.

Because Nutanix, Inc. (NASDAQ:NTNX) has witnessed bearish sentiment from the smart money, it’s easy to see that there was a specific group of money managers that elected to cut their entire stakes by the end of the third quarter. It’s worth mentioning that Renaissance Technologies cut the biggest position of the “upper crust” of funds watched by Insider Monkey, totaling an estimated $13.2 million in stock. Leon Shaulov’s fund, Maplelane Capital, also cut its stock, about $9.1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Nutanix, Inc. (NASDAQ:NTNX). These stocks are Companhia Energetica de Minas Gerais (NYSE:CIG), Choice Hotels International, Inc. (NYSE:CHH), Southwest Gas Holdings, Inc. (NYSE:SWX), and MasTec, Inc. (NYSE:MTZ). This group of stocks’ market valuations are similar to NTNX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CIG | 8 | 54517 | 0 |

| CHH | 20 | 171880 | 1 |

| SWX | 20 | 252769 | 4 |

| MTZ | 32 | 208174 | 4 |

| Average | 20 | 171835 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $172 million. That figure was $321 million in NTNX’s case. MasTec, Inc. (NYSE:MTZ) is the most popular stock in this table. On the other hand Companhia Energetica de Minas Gerais (NYSE:CIG) is the least popular one with only 8 bullish hedge fund positions. Nutanix, Inc. (NASDAQ:NTNX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on NTNX as the stock returned 42.3% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.