The market has been volatile in the last few months as the Federal Reserve continued its rate cuts and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points over the last 12 months. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q2 and the beginning of Q3. In this article, we analyze what the smart money thinks of Arista Networks Inc (NYSE:ANET) and find out how it is affected by hedge funds’ moves.

Hedge fund interest in Arista Networks Inc (NYSE:ANET) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Fifth Third Bancorp (NASDAQ:FITB), Boston Properties, Inc. (NYSE:BXP), and Hewlett Packard Enterprise Company (NYSE:HPE) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the fresh hedge fund action surrounding Arista Networks Inc (NYSE:ANET).

How have hedgies been trading Arista Networks Inc (NYSE:ANET)?

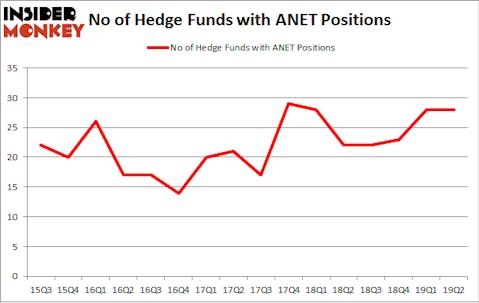

Heading into the third quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ANET over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Arista Networks Inc (NYSE:ANET), which was worth $127.7 million at the end of the second quarter. On the second spot was Polar Capital which amassed $109.3 million worth of shares. Moreover, Citadel Investment Group, Citadel Investment Group, and Incline Global Management were also bullish on Arista Networks Inc (NYSE:ANET), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Arista Networks Inc (NYSE:ANET) has faced falling interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of funds that decided to sell off their full holdings by the end of the second quarter. It’s worth mentioning that Josh Resnick’s Jericho Capital Asset Management dropped the biggest position of the “upper crust” of funds tracked by Insider Monkey, valued at close to $60.1 million in stock. Brandon Haley’s fund, Holocene Advisors, also said goodbye to its stock, about $48.6 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Arista Networks Inc (NYSE:ANET) but similarly valued. We will take a look at Fifth Third Bancorp (NASDAQ:FITB), Boston Properties, Inc. (NYSE:BXP), Hewlett Packard Enterprise Company (NYSE:HPE), and Chipotle Mexican Grill, Inc. (NYSE:CMG). This group of stocks’ market valuations are similar to ANET’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FITB | 29 | 814784 | -9 |

| BXP | 23 | 419884 | -4 |

| HPE | 28 | 836943 | -2 |

| CMG | 37 | 3383462 | 2 |

| Average | 29.25 | 1363768 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $1364 million. That figure was $412 million in ANET’s case. Chipotle Mexican Grill, Inc. (NYSE:CMG) is the most popular stock in this table. On the other hand Boston Properties, Inc. (NYSE:BXP) is the least popular one with only 23 bullish hedge fund positions. Arista Networks Inc (NYSE:ANET) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ANET wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ANET investors were disappointed as the stock returned -8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (see the video below) among hedge funds as many of these stocks already outperformed the market so far in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.