Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. An average long/short hedge fund returned only 5% due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Arista Networks Inc (NYSE:ANET).

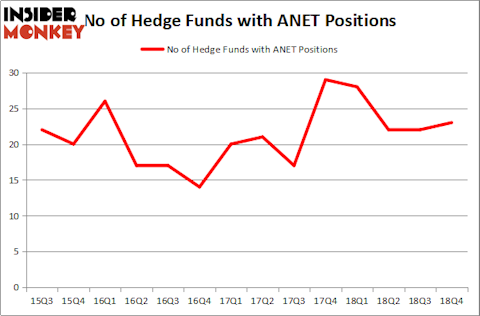

Is Arista Networks Inc (NYSE:ANET) a buy right now? Investors who are in the know are becoming hopeful. The number of bullish hedge fund positions advanced by 1 lately. Our calculations also showed that ANET isn’t among the 30 most popular stocks among hedge funds. ANET was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 22 hedge funds in our database with ANET positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the latest hedge fund action encompassing Arista Networks Inc (NYSE:ANET).

What have hedge funds been doing with Arista Networks Inc (NYSE:ANET)?

Heading into the first quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ANET over the last 14 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Jim Simons’s Renaissance Technologies has the number one position in Arista Networks Inc (NYSE:ANET), worth close to $160.1 million, corresponding to 0.2% of its total 13F portfolio. Coming in second is Ken Griffin of Citadel Investment Group, with a $108.2 million position; 0.1% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism contain Brian Ashford-Russell and Tim Woolley’s Polar Capital, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors.

As aggregate interest increased, some big names were breaking ground themselves. HBK Investments, managed by David Costen Haley, initiated the biggest position in Arista Networks Inc (NYSE:ANET). HBK Investments had $7.8 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also made a $6.2 million investment in the stock during the quarter. The following funds were also among the new ANET investors: D. E. Shaw’s D E Shaw and Claes Fornell’s CSat Investment Advisory.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Arista Networks Inc (NYSE:ANET) but similarly valued. These stocks are First Data Corporation (NYSE:FDC), Barrick Gold Corporation (NYSE:ABX), AmerisourceBergen Corporation (NYSE:ABC), and AMETEK, Inc. (NYSE:AME). This group of stocks’ market valuations are closest to ANET’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FDC | 52 | 2229916 | -9 |

| ABX | 36 | 792139 | 3 |

| ABC | 34 | 381338 | 2 |

| AME | 32 | 885804 | -1 |

| Average | 38.5 | 1072299 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.5 hedge funds with bullish positions and the average amount invested in these stocks was $1072 million. That figure was $513 million in ANET’s case. First Data Corporation (NYSE:FDC) is the most popular stock in this table. On the other hand AMETEK, Inc. (NYSE:AME) is the least popular one with only 32 bullish hedge fund positions. Compared to these stocks Arista Networks Inc (NYSE:ANET) is even less popular than AME but hedge fund sentiment is improving at the moment. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on ANET as the stock returned 40.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.