Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about United Parcel Service, Inc. (NYSE:UPS) and compare its performance to hedge funds’ consensus picks in 2019.

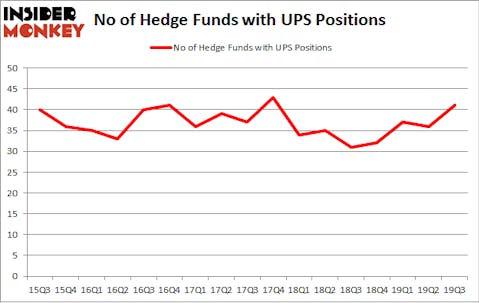

United Parcel Service, Inc. (NYSE:UPS) has experienced an increase in support from the world’s most elite money managers recently. Our calculations also showed that UPS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In today’s marketplace there are a multitude of formulas market participants put to use to size up publicly traded companies. A pair of the less known formulas are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the best investment managers can outclass the market by a solid margin (see the details here).

Aaron Cowen of Suvretta Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to review the fresh hedge fund action surrounding United Parcel Service, Inc. (NYSE:UPS).

What have hedge funds been doing with United Parcel Service, Inc. (NYSE:UPS)?

At Q3’s end, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the previous quarter. By comparison, 31 hedge funds held shares or bullish call options in UPS a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Bill & Melinda Gates Foundation Trust, managed by Michael Larson, holds the biggest position in United Parcel Service, Inc. (NYSE:UPS). Bill & Melinda Gates Foundation Trust has a $542.2 million position in the stock, comprising 2.6% of its 13F portfolio. Coming in second is Two Sigma Advisors, managed by John Overdeck and David Siegel, which holds a $192.9 million position; 0.5% of its 13F portfolio is allocated to the stock. Other peers that hold long positions comprise Aaron Cowen’s Suvretta Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Robert Bishop’s Impala Asset Management. In terms of the portfolio weights assigned to each position Impala Asset Management allocated the biggest weight to United Parcel Service, Inc. (NYSE:UPS), around 6.22% of its 13F portfolio. Suvretta Capital Management is also relatively very bullish on the stock, designating 3.66 percent of its 13F equity portfolio to UPS.

As industrywide interest jumped, specific money managers have jumped into United Parcel Service, Inc. (NYSE:UPS) headfirst. Suvretta Capital Management, managed by Aaron Cowen, assembled the largest position in United Parcel Service, Inc. (NYSE:UPS). Suvretta Capital Management had $141.5 million invested in the company at the end of the quarter. Robert Bishop’s Impala Asset Management also initiated a $86.1 million position during the quarter. The following funds were also among the new UPS investors: Aaron Cowen’s Suvretta Capital Management, Renaissance Technologies, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as United Parcel Service, Inc. (NYSE:UPS) but similarly valued. These stocks are American Express Company (NYSE:AXP), American Tower Corporation (NYSE:AMT), Diageo plc (NYSE:DEO), and 3M Company (NYSE:MMM). This group of stocks’ market valuations resemble UPS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AXP | 48 | 21377087 | 3 |

| AMT | 46 | 3645628 | 4 |

| DEO | 22 | 930335 | 7 |

| MMM | 45 | 825815 | 5 |

| Average | 40.25 | 6694716 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.25 hedge funds with bullish positions and the average amount invested in these stocks was $6695 million. That figure was $1366 million in UPS’s case. American Express Company (NYSE:AXP) is the most popular stock in this table. On the other hand Diageo plc (NYSE:DEO) is the least popular one with only 22 bullish hedge fund positions. United Parcel Service, Inc. (NYSE:UPS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately UPS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on UPS were disappointed as the stock returned 26.2% in 2019 (through December 23rd) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.