Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. What do these smart investors think about United Parcel Service, Inc. (NYSE:UPS)?

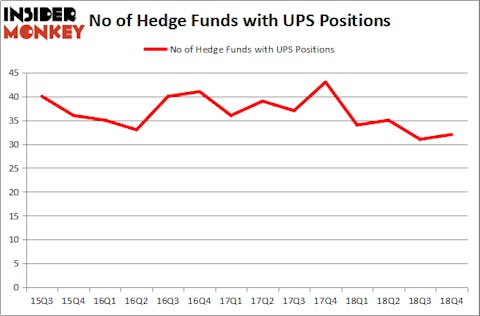

United Parcel Service, Inc. (NYSE:UPS) investors should be aware of an increase in hedge fund interest in recent months. Our calculations also showed that UPS isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action encompassing United Parcel Service, Inc. (NYSE:UPS).

How are hedge funds trading United Parcel Service, Inc. (NYSE:UPS)?

Heading into the first quarter of 2019, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of 3% from one quarter earlier. On the other hand, there were a total of 34 hedge funds with a bullish position in UPS a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Michael Larson’s Bill & Melinda Gates Foundation Trust has the largest position in United Parcel Service, Inc. (NYSE:UPS), worth close to $441.4 million, accounting for 2% of its total 13F portfolio. Sitting at the No. 2 spot is Two Sigma Advisors, managed by John Overdeck and David Siegel, which holds a $229.7 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Some other peers with similar optimism comprise John Smith Clark’s Southpoint Capital Advisors, Boykin Curry’s Eagle Capital Management and Ken Griffin’s Citadel Investment Group.

As industrywide interest jumped, specific money managers have been driving this bullishness. Impala Asset Management, managed by Robert Bishop, initiated the most valuable position in United Parcel Service, Inc. (NYSE:UPS). Impala Asset Management had $18.9 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $10.5 million investment in the stock during the quarter. The other funds with brand new UPS positions are Benjamin A. Smith’s Laurion Capital Management, Paul Cantor, Joseph Weiss, and Will Wurm’s Beech Hill Partners, and Claes Fornell’s CSat Investment Advisory.

Let’s go over hedge fund activity in other stocks similar to United Parcel Service, Inc. (NYSE:UPS). These stocks are Banco Santander (Brasil) SA (NYSE:BSBR), NextEra Energy, Inc. (NYSE:NEE), Rio Tinto plc (NYSE:RIO), and NVIDIA Corporation (NASDAQ:NVDA). This group of stocks’ market valuations match UPS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSBR | 10 | 170883 | 3 |

| NEE | 37 | 943957 | 5 |

| RIO | 23 | 1143298 | 3 |

| NVDA | 41 | 1158110 | -15 |

| Average | 27.75 | 854062 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.75 hedge funds with bullish positions and the average amount invested in these stocks was $854 million. That figure was $1158 million in UPS’s case. NVIDIA Corporation (NASDAQ:NVDA) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (NYSE:BSBR) is the least popular one with only 10 bullish hedge fund positions. United Parcel Service, Inc. (NYSE:UPS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on UPS as the stock returned 13.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.