The consumer finance industry should see a rebound in the credit markets, although this might not be the best news for the likes of card transaction companies Mastercard Inc (NYSE:MA) and Visa Inc (NYSE:V). Regulatory changes should result in banks marketing more toward credit cards than debit cards. As a result, volume will be down, but margins have the potential to expand. The higher level of regulatory security is overall more of a positive for credit, versus fee income. Yet, we see continued tight credit markets, soft consumer confidence, and caution toward debt as a reason that card transaction companies can still a good investment. As well, both of these companies are poised to be pioneers in the mobile payments industry.

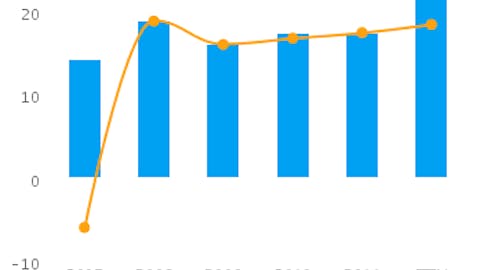

Mastercard, the global leader in transaction processing, is expected to benefit from the rise in gross dollar volume, which should help drive revenues up 10% for 2012. As well, fueling longer-term growth is Mastercard’s movement into e-commerce payments and prepaid cards. Mastercard has multiple growth initiatives, which includes the transition from cash to electronic payments in emerging markets. Mastercard saw its last quarter EPS up to $5.65, compared to $4.76 from the same quarter last year, and above consensus of $5.58.

Mastercard called Viking Global as its top fund investor by shares, with 1.5 million and over 5% of their 2Q 13F portfolio. The company also called Gardner Russo & Gardner and Tiger Global Management as top investors, each also with over 5% of their 2Q 13Fs invested in Mastercard.

Visa should see operating revenues up 13% in 2012; this comes after a 14% increase in 2011. Payment volume for Visa’s overseas markets is expected to continue to drive service fees, namely in emerging markets. As well, even as the domestic U.S. market continues to be weak, Visa’s overseas diversification is a positive. Visa has managed to beat EPS for each of the last four quarters, and has announced plans to partner with Vodafone in an effort to move into mobile payments. Visa is one of our 5-high multiple stocks loved by hedge funds. SPO Advisory Corp owned over 7 million shares, and had 13% of the firm’s 2Q 13F portfolio invested in Visa. Top funds Lone Pine Capital, Fisher Asset Management, Tiger Global Management all also owned over 3 million shares each. Tiger Global is a big believer of both Visa and Mastercard, having both companies as a top ten pick and increasing their 1Q stake during 2Q; check out all of Tiger Global’s stock picks.

Visa and Mastercard are not in direct competition with Discover Financial Services (NYSE:DFS), American Express Company (NYSE:AXP), and Capital One Financial Corp. (NYSE:COF), given neither Visa or Mastercard actually have any liabilities or risks related to lending to customers.

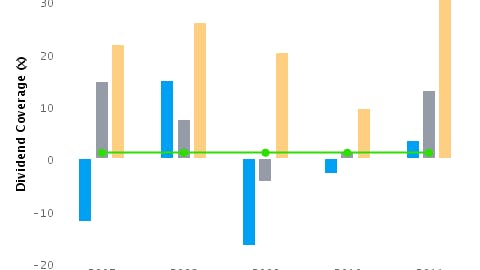

Of the card companies, Discover is up the most year-to-date at 70%. The company has grown sales around 2% annually over the last fourteen years. Yet, the most recent quarter saw revenues up 10% from the same quarter last year. Discover appears to be improving its accounts quality, with losses falling to only 2.3% from 3.6% a year earlier. However, the consensus estimates show a decline in EPS for 2013, from $4.43 in 2012 to $4.15, on the assumption that credit markets will remain weak in the interim; check out our thoughts on whether Discover is better than Visa or Mastercard.

American Express is expected to actually grow revenue in 2012 and 2013 in the range of 6%-7%. The company has pivoted a focus from loan growth to cater to spending customers, which accounts for over 50% of the company’s revenues. American Express is also improving its credit portfolio, having a net write-off rate for lending at 1.9% for 3Q, compared to 2.6% for the same quarter last year. Of all the credit card companies, American Express boosts the top fund manager in our view, with Warren Buffett having almost 12% of his 2Q 13F invested in the card company; check out all of Buffet’s picks.

Capital One acquired ING Direct in early 2012, which actually boosted the company’s deposits by 75%. Then in May, Capital One acquired HSBC’s U.S. card portfolio, boosting credit card receivables to about 44%. Capital One has undertaken a similar strategy as has American Express, reducing its exposure to borrowers and focusing on spenders. The ING acquisition now gives the company low-cost deposit funding and the ability to cross-sell. Capital One’s top two investors were Eddie Lampert and John Paulson, although Paulson did dump 50% of his shares during 2Q.

We believe that consumer’s continued shyness toward credit and the increased credit standards by card companies will hamper the growth of this industry. While the credit card companies are expected to grow five-year earnings at a only around 10% compounded annual growth or lower, Mastercard and Visa are expected to grow at 19% and 20%, respectively. Both transaction companies also have the greater operational leverage given they have no debt compared to the other trio discussed here. We see Visa having some of the best near-term growth prospects given their exposure to mobile payments, but we see Mastercard as the best value. Visa and Mastercard trade in line on a forward P/E basis, at 17x and 18x respectively. Yet, on a PEG basis Mastercard comes in at only 1.4, compared to Visa’s 7.0. We would consider Mastercard a buying opportunity, and would consider Visa a stock to watch on a pull back.