Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees in 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the third quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Western Digital Corporation (NASDAQ:WDC).

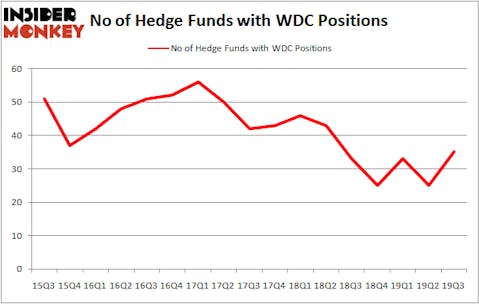

Is Western Digital Corporation (NASDAQ:WDC) the right pick for your portfolio? The smart money is taking an optimistic view. The number of long hedge fund positions inched up by 10 lately. Our calculations also showed that WDC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a large number of metrics stock traders use to appraise stocks. Two of the most innovative metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outperform their index-focused peers by a very impressive margin (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s view the fresh hedge fund action encompassing Western Digital Corporation (NASDAQ:WDC).

How are hedge funds trading Western Digital Corporation (NASDAQ:WDC)?

Heading into the fourth quarter of 2019, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 40% from one quarter earlier. By comparison, 33 hedge funds held shares or bullish call options in WDC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Lyrical Asset Management held the most valuable stake in Western Digital Corporation (NASDAQ:WDC), which was worth $255.1 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $172.9 million worth of shares. Iridian Asset Management, Renaissance Technologies, and Partner Fund Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Lyrical Asset Management allocated the biggest weight to Western Digital Corporation (NASDAQ:WDC), around 3.84% of its portfolio. Tegean Capital Management is also relatively very bullish on the stock, setting aside 3.55 percent of its 13F equity portfolio to WDC.

Now, key hedge funds have been driving this bullishness. Partner Fund Management, managed by Christopher James, established the most outsized position in Western Digital Corporation (NASDAQ:WDC). Partner Fund Management had $47.5 million invested in the company at the end of the quarter. Larry Chen and Terry Zhang’s Tairen Capital also made a $18.4 million investment in the stock during the quarter. The following funds were also among the new WDC investors: Israel Englander’s Millennium Management, Steve Cohen’s Point72 Asset Management, and Israel Englander’s Millennium Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Western Digital Corporation (NASDAQ:WDC) but similarly valued. These stocks are New Oriental Education & Tech Group Inc. (NYSE:EDU), Healthpeak Properties, Inc. (NYSE:HCP), Alexandria Real Estate Equities Inc (NYSE:ARE), and STMicroelectronics N.V. (NYSE:STM). This group of stocks’ market caps are closest to WDC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EDU | 35 | 1511145 | 3 |

| HCP | 25 | 562264 | -1 |

| ARE | 21 | 343145 | -6 |

| STM | 11 | 94533 | -2 |

| Average | 23 | 627772 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $628 million. That figure was $905 million in WDC’s case. New Oriental Education & Tech Group Inc. (NYSE:EDU) is the most popular stock in this table. On the other hand STMicroelectronics N.V. (NYSE:STM) is the least popular one with only 11 bullish hedge fund positions. Western Digital Corporation (NASDAQ:WDC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately WDC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WDC were disappointed as the stock returned -14.9% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.