Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 37.4% through the end of November and outperformed the broader market benchmark by 9.9 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

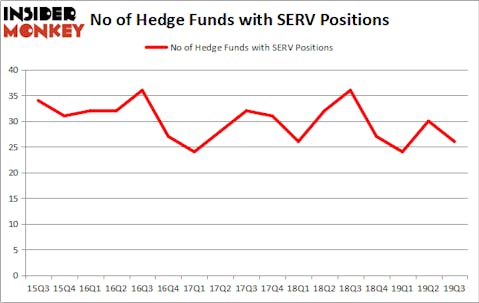

Is ServiceMaster Global Holdings Inc (NYSE:SERV) a great stock to buy now? Hedge funds are getting less optimistic. The number of long hedge fund positions decreased by 4 recently. Our calculations also showed that SERV isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). SERV was in 26 hedge funds’ portfolios at the end of September. There were 30 hedge funds in our database with SERV positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Jeffrey Gates of Gates Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the new hedge fund action regarding ServiceMaster Global Holdings Inc (NYSE:SERV).

What have hedge funds been doing with ServiceMaster Global Holdings Inc (NYSE:SERV)?

Heading into the fourth quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the previous quarter. By comparison, 36 hedge funds held shares or bullish call options in SERV a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

The largest stake in ServiceMaster Global Holdings Inc (NYSE:SERV) was held by Select Equity Group, which reported holding $488.1 million worth of stock at the end of September. It was followed by Gates Capital Management with a $85.6 million position. Other investors bullish on the company included Iridian Asset Management, Citadel Investment Group, and Arrowstreet Capital. In terms of the portfolio weights assigned to each position Gates Capital Management allocated the biggest weight to ServiceMaster Global Holdings Inc (NYSE:SERV), around 3.71% of its portfolio. Select Equity Group is also relatively very bullish on the stock, setting aside 3.3 percent of its 13F equity portfolio to SERV.

Due to the fact that ServiceMaster Global Holdings Inc (NYSE:SERV) has experienced falling interest from the smart money, we can see that there exists a select few hedge funds who were dropping their full holdings in the third quarter. Interestingly, Principal Global Investors’s Columbus Circle Investors dropped the largest investment of the “upper crust” of funds tracked by Insider Monkey, totaling about $11.6 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund said goodbye to about $3.4 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 4 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to ServiceMaster Global Holdings Inc (NYSE:SERV). We will take a look at AptarGroup, Inc. (NYSE:ATR), AngloGold Ashanti Limited (NYSE:AU), BorgWarner Inc. (NYSE:BWA), and Nielsen Holdings plc (NYSE:NLSN). This group of stocks’ market values resemble SERV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATR | 22 | 112361 | 2 |

| AU | 19 | 454469 | 3 |

| BWA | 22 | 718476 | 1 |

| NLSN | 30 | 1129196 | -5 |

| Average | 23.25 | 603626 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $604 million. That figure was $928 million in SERV’s case. Nielsen Holdings plc (NYSE:NLSN) is the most popular stock in this table. On the other hand AngloGold Ashanti Limited (NYSE:AU) is the least popular one with only 19 bullish hedge fund positions. ServiceMaster Global Holdings Inc (NYSE:SERV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately SERV wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SERV were disappointed as the stock returned -29.9% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.