Is ServiceMaster Global Holdings Inc (NYSE:SERV) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

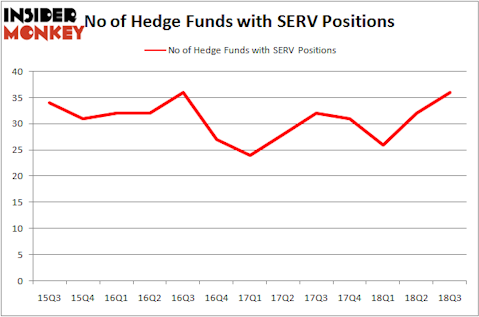

ServiceMaster Global Holdings Inc (NYSE:SERV) has seen an increase in enthusiasm from smart money lately. SERV was in 36 hedge funds’ portfolios at the end of September. There were 32 hedge funds in our database with SERV holdings at the end of the previous quarter. Our calculations also showed that SERV isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of methods investors employ to size up publicly traded companies. Some of the less utilized methods are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best fund managers can beat the broader indices by a solid amount (see the details here).

Let’s review the latest hedge fund action regarding ServiceMaster Global Holdings Inc (NYSE:SERV).

What does the smart money think about ServiceMaster Global Holdings Inc (NYSE:SERV)?

At Q3’s end, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from one quarter earlier. On the other hand, there were a total of 31 hedge funds with a bullish position in SERV at the beginning of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

The largest stake in ServiceMaster Global Holdings Inc (NYSE:SERV) was held by Iridian Asset Management, which reported holding $282.4 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $140.5 million position. Other investors bullish on the company included Gates Capital Management, Governors Lane, and Cantillon Capital Management.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Governors Lane, managed by Isaac Corre, initiated the biggest position in ServiceMaster Global Holdings Inc (NYSE:SERV). Governors Lane had $71.1 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also made a $31.6 million investment in the stock during the quarter. The following funds were also among the new SERV investors: Michael Platt and William Reeves’s BlueCrest Capital Mgmt., Barry Rosenstein’s JANA Partners, and Steve Cohen’s Point72 Asset Management.

Let’s go over hedge fund activity in other stocks similar to ServiceMaster Global Holdings Inc (NYSE:SERV). These stocks are Twilio Inc. (NYSE:TWLO), DENTSPLY SIRONA Inc. (NASDAQ:XRAY), ICON Public Limited Company (NASDAQ:ICLR), and L Brands Inc (NYSE:LB). This group of stocks’ market values are similar to SERV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TWLO | 41 | 1168477 | 9 |

| XRAY | 28 | 1252948 | 5 |

| ICLR | 22 | 577377 | 7 |

| LB | 27 | 685137 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $921 million. That figure was $1.17 million in SERV’s case. Twilio Inc. (NYSE:TWLO) is the most popular stock in this table. On the other hand ICON Public Limited Company (NASDAQ:ICLR) is the least popular one with only 22 bullish hedge fund positions. ServiceMaster Global Holdings Inc (NYSE:SERV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TWLO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.