The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. We are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article we look at how hedge funds traded Fate Therapeutics Inc (NASDAQ:FATE) and determine whether the smart money was really smart about this stock.

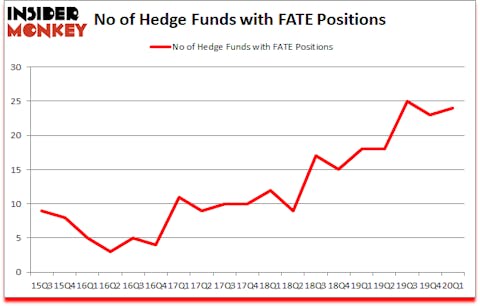

Is Fate Therapeutics Inc (NASDAQ:FATE) a bargain? Money managers were turning bullish. The number of bullish hedge fund bets rose by 1 recently. Our calculations also showed that FATE isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, on one site we found out that NBA champion Isiah Thomas is now the CEO of this cannabis company. The same site also talks about a snack manufacturer that’s growing at 30% annually. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Keeping this in mind let’s review the fresh hedge fund action surrounding Fate Therapeutics Inc (NASDAQ:FATE).

Hedge fund activity in Fate Therapeutics Inc (NASDAQ:FATE)

At Q1’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FATE over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Redmile Group, managed by Jeremy Green, holds the most valuable position in Fate Therapeutics Inc (NASDAQ:FATE). Redmile Group has a $249.1 million position in the stock, comprising 7% of its 13F portfolio. The second most bullish fund manager is Farallon Capital, holding a $66.6 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Other peers with similar optimism include Eli Casdin’s Casdin Capital, Oleg Nodelman’s EcoR1 Capital and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Redmile Group allocated the biggest weight to Fate Therapeutics Inc (NASDAQ:FATE), around 6.98% of its 13F portfolio. Casdin Capital is also relatively very bullish on the stock, setting aside 6.01 percent of its 13F equity portfolio to FATE.

As industrywide interest jumped, key money managers have jumped into Fate Therapeutics Inc (NASDAQ:FATE) headfirst. Logos Capital, managed by Arsani William, created the most valuable position in Fate Therapeutics Inc (NASDAQ:FATE). Logos Capital had $4.3 million invested in the company at the end of the quarter. Bhagwan Jay Rao’s Integral Health Asset Management also initiated a $2.1 million position during the quarter. The other funds with brand new FATE positions are Bihua Chen’s Cormorant Asset Management, Louis Bacon’s Moore Global Investments, and Michael Gelband’s ExodusPoint Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Fate Therapeutics Inc (NASDAQ:FATE). We will take a look at Golub Capital BDC Inc (NASDAQ:GBDC), Genworth Financial Inc (NYSE:GNW), Option Care Health, Inc. (NASDAQ:OPCH), and Spectrum Brands Holdings, Inc. (NYSE:SPB). This group of stocks’ market valuations are closest to FATE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GBDC | 13 | 52793 | -3 |

| GNW | 32 | 258511 | 0 |

| OPCH | 7 | 12260 | -7 |

| SPB | 24 | 207647 | -21 |

| Average | 19 | 132803 | -7.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $133 million. That figure was $582 million in FATE’s case. Genworth Financial Inc (NYSE:GNW) is the most popular stock in this table. On the other hand Option Care Health, Inc. (NASDAQ:OPCH) is the least popular one with only 7 bullish hedge fund positions. Fate Therapeutics Inc (NASDAQ:FATE) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still beat the market by 15.5 percentage points. Hedge funds were also right about betting on FATE as the stock returned 54.5% in Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Fate Therapeutics Inc (NASDAQ:FATE)

Follow Fate Therapeutics Inc (NASDAQ:FATE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.