In this article we will analyze whether NGM Biopharmaceuticals, Inc. (NASDAQ:NGM) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

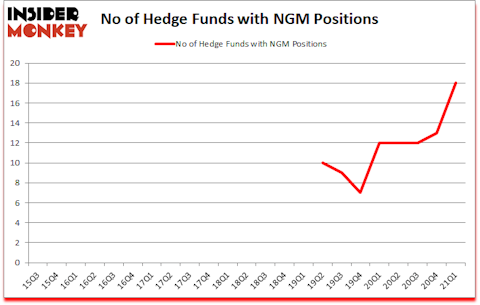

Is NGM Biopharmaceuticals, Inc. (NASDAQ:NGM) a superb investment today? The smart money was taking an optimistic view. The number of bullish hedge fund bets rose by 5 in recent months. NGM Biopharmaceuticals, Inc. (NASDAQ:NGM) was in 18 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic was previously 13. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that NGM isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

To most stock holders, hedge funds are perceived as unimportant, outdated financial tools of yesteryear. While there are over 8000 funds in operation at the moment, We choose to focus on the crème de la crème of this group, around 850 funds. Most estimates calculate that this group of people watch over the lion’s share of all hedge funds’ total asset base, and by monitoring their best investments, Insider Monkey has figured out many investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Paul Marshall of Marshall Wace

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s analyze the fresh hedge fund action surrounding NGM Biopharmaceuticals, Inc. (NASDAQ:NGM).

Do Hedge Funds Think NGM Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in NGM a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Redmile Group held the most valuable stake in NGM Biopharmaceuticals, Inc. (NASDAQ:NGM), which was worth $80 million at the end of the fourth quarter. On the second spot was Point72 Asset Management which amassed $63.2 million worth of shares. Greenspring Associates, Euclidean Capital, and Aquilo Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Greenspring Associates allocated the biggest weight to NGM Biopharmaceuticals, Inc. (NASDAQ:NGM), around 36.38% of its 13F portfolio. Euclidean Capital is also relatively very bullish on the stock, earmarking 14.53 percent of its 13F equity portfolio to NGM.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Redmile Group, managed by Jeremy Green, established the largest position in NGM Biopharmaceuticals, Inc. (NASDAQ:NGM). Redmile Group had $80 million invested in the company at the end of the quarter. Farallon Capital also made a $10.9 million investment in the stock during the quarter. The following funds were also among the new NGM investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, John Overdeck and David Siegel’s Two Sigma Advisors, and Israel Englander’s Millennium Management.

Let’s go over hedge fund activity in other stocks similar to NGM Biopharmaceuticals, Inc. (NASDAQ:NGM). These stocks are Dream Finders Homes, Inc. (NASDAQ:DFH), World Fuel Services Corporation (NYSE:INT), GCM Grosvenor Inc. (NASDAQ:GCMG), Xenia Hotels & Resorts Inc (NYSE:XHR), Paramount Group Inc (NYSE:PGRE), Azul S.A. (NYSE:AZUL), and TowneBank (NASDAQ:TOWN). This group of stocks’ market valuations are similar to NGM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DFH | 10 | 54869 | 10 |

| INT | 15 | 85346 | -3 |

| GCMG | 17 | 181069 | 1 |

| XHR | 6 | 8631 | 0 |

| PGRE | 17 | 135595 | -1 |

| AZUL | 11 | 69381 | -6 |

| TOWN | 9 | 43368 | 1 |

| Average | 12.1 | 82608 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.1 hedge funds with bullish positions and the average amount invested in these stocks was $83 million. That figure was $329 million in NGM’s case. GCM Grosvenor Inc. (NASDAQ:GCMG) is the most popular stock in this table. On the other hand Xenia Hotels & Resorts Inc (NYSE:XHR) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks NGM Biopharmaceuticals, Inc. (NASDAQ:NGM) is more popular among hedge funds. Our overall hedge fund sentiment score for NGM is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.5% in 2021 through July 23rd and still beat the market by 10.1 percentage points. Unfortunately NGM wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on NGM were disappointed as the stock returned -27% since the end of the first quarter (through 7/23) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Ngm Biopharmaceuticals Inc (NASDAQ:NGM)

Follow Ngm Biopharmaceuticals Inc (NASDAQ:NGM)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Oil Refining Companies

- 15 Best Clean Energy Stocks to Invest In

- 33 Most Famous Harvard Students of All Time

Disclosure: None. This article was originally published at Insider Monkey.