We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 835 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Intelsat S.A. (NYSE:I) in this article.

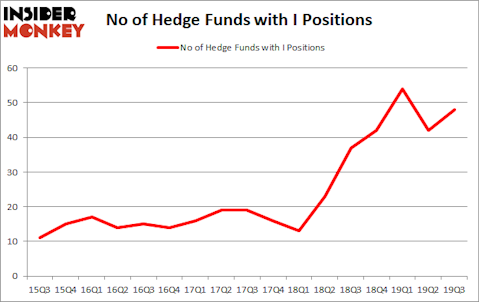

Intelsat S.A. (NYSE:I) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 49 hedge funds’ portfolios at the end of the fourth quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Third Point Reinsurance Ltd (NYSE:TPRE), Hollysys Automation Technologies Ltd (NASDAQ:HOLI), and Urstadt Biddle Properties Inc (NYSE:UBA) to gather more data points. Our calculations also showed that I isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the eyes of most investors, hedge funds are assumed to be worthless, outdated financial tools of the past. While there are over 8000 funds trading at present, We choose to focus on the masters of this club, about 850 funds. It is estimated that this group of investors oversee bulk of all hedge funds’ total capital, and by monitoring their highest performing investments, Insider Monkey has come up with a number of investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a gander at the new hedge fund action surrounding Intelsat S.A. (NYSE:I).

What have hedge funds been doing with Intelsat S.A. (NYSE:I)?

Heading into the first quarter of 2020, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 42 hedge funds with a bullish position in I a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Intelsat S.A. (NYSE:I) was held by Discovery Capital Management, which reported holding $60.7 million worth of stock at the end of September. It was followed by Silver Lake Partners with a $49.3 million position. Other investors bullish on the company included Key Square Capital Management, Point State Capital, and Pentwater Capital Management. In terms of the portfolio weights assigned to each position Discovery Capital Management allocated the biggest weight to Intelsat S.A. (NYSE:I), around 19.27% of its 13F portfolio. Key Square Capital Management is also relatively very bullish on the stock, dishing out 12.18 percent of its 13F equity portfolio to I.

Because Intelsat S.A. (NYSE:I) has witnessed falling interest from the entirety of the hedge funds we track, logic holds that there is a sect of hedge funds who sold off their entire stakes heading into Q4. At the top of the heap, Mark T. Gallogly’s Centerbridge Partners sold off the largest investment of all the hedgies watched by Insider Monkey, totaling close to $24.4 million in stock. Sahm Adrangi’s fund, Kerrisdale Capital, also sold off its stock, about $21.8 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Intelsat S.A. (NYSE:I). We will take a look at Third Point Reinsurance Ltd (NYSE:TPRE), Hollysys Automation Technologies Ltd (NASDAQ:HOLI), Urstadt Biddle Properties Inc (NYSE:UBA), and Diamond Offshore Drilling Inc (NYSE:DO). This group of stocks’ market values resemble I’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPRE | 20 | 66860 | 0 |

| HOLI | 12 | 67036 | -2 |

| UBA | 6 | 37997 | -6 |

| DO | 16 | 157217 | 1 |

| Average | 13.5 | 82278 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $82 million. That figure was $394 million in I’s case. Third Point Reinsurance Ltd (NYSE:TPRE) is the most popular stock in this table. On the other hand Urstadt Biddle Properties Inc (NYSE:UBA) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Intelsat S.A. (NYSE:I) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st and still beat the market by 12.9 percentage points. Unfortunately I wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on I were disappointed as the stock returned -81.7% during the four months of 2020 (through May 1st) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.