Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. With this in mind let’s see whether Hormel Foods Corporation (NYSE:HRL) makes for a good investment at the moment. We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

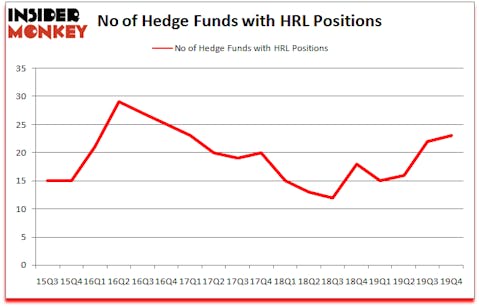

Is Hormel Foods Corporation (NYSE:HRL) going to take off soon? Prominent investors are taking a bullish view. The number of bullish hedge fund positions advanced by 1 in recent months. Our calculations also showed that HRL isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). HRL was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 22 hedge funds in our database with HRL holdings at the end of the previous quarter.

Philippe Laffont of Coatue Management

We leave no stone unturned when looking for the next great investment idea. For example, COVID-19 pandemic is still the main driver of stock prices. So we are checking out this trader’s corona catalyst trades. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to go over the latest hedge fund action encompassing Hormel Foods Corporation (NYSE:HRL).

What have hedge funds been doing with Hormel Foods Corporation (NYSE:HRL)?

At Q4’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards HRL over the last 18 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Hormel Foods Corporation (NYSE:HRL), which was worth $121.9 million at the end of the third quarter. On the second spot was GLG Partners which amassed $26.4 million worth of shares. Renaissance Technologies, Citadel Investment Group, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Cognios Capital allocated the biggest weight to Hormel Foods Corporation (NYSE:HRL), around 0.88% of its 13F portfolio. Quantinno Capital is also relatively very bullish on the stock, earmarking 0.23 percent of its 13F equity portfolio to HRL.

With a general bullishness amongst the heavyweights, key money managers have jumped into Hormel Foods Corporation (NYSE:HRL) headfirst. Renaissance Technologies, established the most outsized position in Hormel Foods Corporation (NYSE:HRL). Renaissance Technologies had $26.1 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $3.6 million investment in the stock during the quarter. The other funds with brand new HRL positions are Philippe Laffont’s Coatue Management, Israel Englander’s Millennium Management, and Hoon Kim’s Quantinno Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Hormel Foods Corporation (NYSE:HRL) but similarly valued. These stocks are Realty Income Corporation (NYSE:O), STMicroelectronics N.V. (NYSE:STM), Waste Connections, Inc. (NYSE:WCN), and Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN). This group of stocks’ market valuations match HRL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| O | 26 | 394173 | 8 |

| STM | 17 | 146213 | 4 |

| WCN | 37 | 623995 | 3 |

| ALXN | 48 | 2927643 | 0 |

| Average | 32 | 1023006 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32 hedge funds with bullish positions and the average amount invested in these stocks was $1023 million. That figure was $240 million in HRL’s case. Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is the most popular stock in this table. On the other hand STMicroelectronics N.V. (NYSE:STM) is the least popular one with only 17 bullish hedge fund positions. Hormel Foods Corporation (NYSE:HRL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but still beat the market by 12.9 percentage points. A small number of hedge funds were also right about betting on HRL as the stock returned 4.4% during the same time period and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.