Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first quarter, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first quarter still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Hormel Foods Corporation (NYSE:HRL) changed recently.

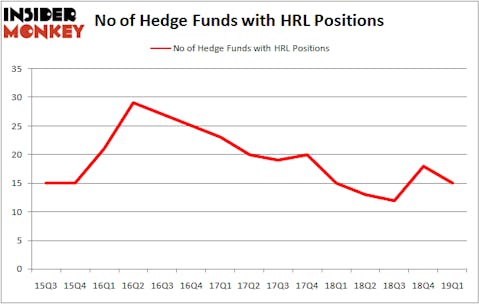

Is Hormel Foods Corporation (NYSE:HRL) a safe investment today? Investors who are in the know are getting less bullish. The number of long hedge fund bets fell by 3 recently. Our calculations also showed that HRL isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are perceived as unimportant, outdated financial tools of the past. While there are greater than 8000 funds trading today, Our experts hone in on the moguls of this club, about 750 funds. These money managers command bulk of the hedge fund industry’s total capital, and by tracking their finest investments, Insider Monkey has found various investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to check out the recent hedge fund action surrounding Hormel Foods Corporation (NYSE:HRL).

What does smart money think about Hormel Foods Corporation (NYSE:HRL)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -17% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in HRL a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in Hormel Foods Corporation (NYSE:HRL) was held by AQR Capital Management, which reported holding $74.9 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $17.1 million position. Other investors bullish on the company included Adage Capital Management, Gotham Asset Management, and GLG Partners.

Because Hormel Foods Corporation (NYSE:HRL) has witnessed falling interest from the smart money, logic holds that there is a sect of hedgies that elected to cut their entire stakes in the third quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dropped the biggest stake of all the hedgies watched by Insider Monkey, worth about $8.2 million in stock. James Dondero’s fund, Highland Capital Management, also said goodbye to its stock, about $2.1 million worth. These transactions are interesting, as total hedge fund interest dropped by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Hormel Foods Corporation (NYSE:HRL). These stocks are The Hershey Company (NYSE:HSY), Wipro Limited (NYSE:WIT), Arista Networks Inc (NYSE:ANET), and T. Rowe Price Group, Inc. (NASDAQ:TROW). This group of stocks’ market caps resemble HRL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HSY | 22 | 541491 | -11 |

| WIT | 11 | 106818 | 1 |

| ANET | 28 | 714547 | 5 |

| TROW | 26 | 519659 | 4 |

| Average | 21.75 | 470629 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $471 million. That figure was $138 million in HRL’s case. Arista Networks Inc (NYSE:ANET) is the most popular stock in this table. On the other hand Wipro Limited (NYSE:WIT) is the least popular one with only 11 bullish hedge fund positions. Hormel Foods Corporation (NYSE:HRL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately HRL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); HRL investors were disappointed as the stock returned -7.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.