Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

Is Workday Inc (NASDAQ:WDAY) going to take off soon? The smart money is getting more bullish. The number of bullish hedge fund bets moved up by 1 recently. Our calculations also showed that WDAY isn’t among the 30 most popular stocks among hedge funds. WDAY was in 31 hedge funds’ portfolios at the end of December. There were 30 hedge funds in our database with WDAY holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the fresh hedge fund action regarding Workday Inc (NASDAQ:WDAY).

How are hedge funds trading Workday Inc (NASDAQ:WDAY)?

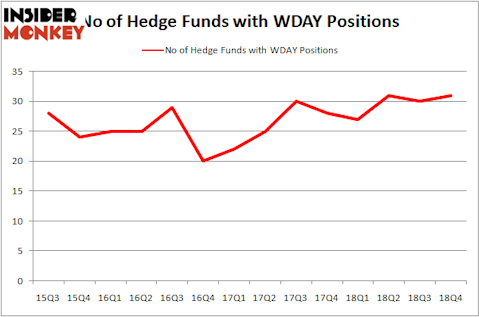

Heading into the first quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 3% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards WDAY over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Brian Bares’s Bares Capital Management has the largest position in Workday Inc (NASDAQ:WDAY), worth close to $307 million, comprising 9.3% of its total 13F portfolio. Coming in second is Matrix Capital Management, managed by David Goel and Paul Ferri, which holds a $223.6 million position; the fund has 7.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish contain Panayotis Takis Sparaggis’s Alkeon Capital Management, Brandon Haley’s Holocene Advisors and Stanley Druckenmiller’s Duquesne Capital.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Workday Inc (NASDAQ:WDAY) headfirst. Holocene Advisors established the largest position in Workday Inc (NASDAQ:WDAY). Holocene Advisors had $143.2 million invested in the company at the end of the quarter. Christian Leone’s Luxor Capital Group also initiated a $59.4 million position during the quarter. The following funds were also among the new WDAY investors: Robert Henry Lynch’s Aristeia Capital, Philippe Laffont’s Coatue Management, and Howard Marks’s Oaktree Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Workday Inc (NASDAQ:WDAY) but similarly valued. We will take a look at Carnival plc (NYSE:CUK), Baxter International Inc. (NYSE:BAX), Aon plc (NYSE:AON), and Altaba Inc. (NASDAQ:AABA). All of these stocks’ market caps are closest to WDAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CUK | 8 | 84703 | 0 |

| BAX | 36 | 3121102 | -7 |

| AON | 40 | 2187808 | 10 |

| AABA | 73 | 12595295 | -14 |

| Average | 39.25 | 4497227 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.25 hedge funds with bullish positions and the average amount invested in these stocks was $4497 million. That figure was $1073 million in WDAY’s case. Altaba Inc. (NASDAQ:AABA) is the most popular stock in this table. On the other hand Carnival plc (NYSE:CUK) is the least popular one with only 8 bullish hedge fund positions. Workday Inc (NASDAQ:WDAY) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on WDAY, though not to the same extent, as the stock returned 16.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.