Is Hilton Worldwide Holdings Inc (NYSE:HLT) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

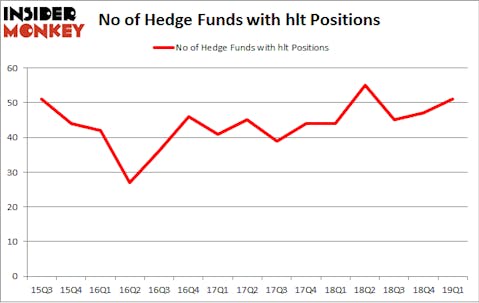

Is Hilton Worldwide Holdings Inc (NYSE:HLT) a marvelous investment today? Hedge funds are buying. The number of long hedge fund bets improved by 4 recently. Our calculations also showed that hlt isn’t among the 30 most popular stocks among hedge funds. HLT was in 51 hedge funds’ portfolios at the end of March. There were 47 hedge funds in our database with HLT positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the new hedge fund action encompassing Hilton Worldwide Holdings Inc (NYSE:HLT).

How are hedge funds trading Hilton Worldwide Holdings Inc (NYSE:HLT)?

At the end of the first quarter, a total of 51 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HLT over the last 15 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Pershing Square held the most valuable stake in Hilton Worldwide Holdings Inc (NYSE:HLT), which was worth $911.4 million at the end of the first quarter. On the second spot was D1 Capital Partners which amassed $510.8 million worth of shares. Moreover, Eagle Capital Management, OZ Management, and Soroban Capital Partners were also bullish on Hilton Worldwide Holdings Inc (NYSE:HLT), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers have jumped into Hilton Worldwide Holdings Inc (NYSE:HLT) headfirst. Hitchwood Capital Management, managed by James Crichton, established the biggest position in Hilton Worldwide Holdings Inc (NYSE:HLT). Hitchwood Capital Management had $70.2 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also made a $33.1 million investment in the stock during the quarter. The other funds with brand new HLT positions are Guy Shahar’s DSAM Partners, Jim Simons’s Renaissance Technologies, and Michael Gelband’s ExodusPoint Capital.

Let’s go over hedge fund activity in other stocks similar to Hilton Worldwide Holdings Inc (NYSE:HLT). These stocks are Ctrip.com International, Ltd. (NASDAQ:CTRP), Archer-Daniels-Midland Company (NYSE:ADM), Barrick Gold Corporation (NYSE:GOLD), and TransDigm Group Incorporated (NYSE:TDG). This group of stocks’ market valuations are similar to HLT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTRP | 29 | 1288524 | 8 |

| ADM | 25 | 625238 | -4 |

| GOLD | 37 | 956008 | 1 |

| TDG | 52 | 4683686 | 5 |

| Average | 35.75 | 1888364 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.75 hedge funds with bullish positions and the average amount invested in these stocks was $1888 million. That figure was $3977 million in HLT’s case. TransDigm Group Incorporated (NYSE:TDG) is the most popular stock in this table. On the other hand Archer-Daniels-Midland Company (NYSE:ADM) is the least popular one with only 25 bullish hedge fund positions. Hilton Worldwide Holdings Inc (NYSE:HLT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on HLT as the stock returned 8.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.