The market has been volatile in the fourth quarter as the Federal Reserve continued its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Bausch Health Companies (NYSE:BHC) and find out how it is affected by hedge funds’ moves.

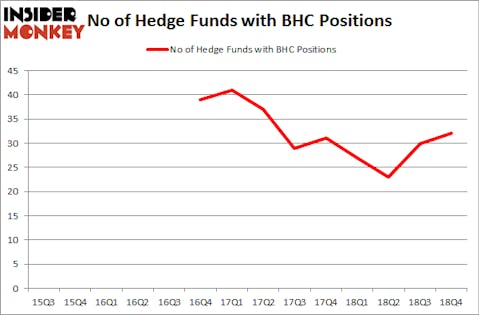

Bausch Health Companies (NYSE:BHC) was in 32 hedge funds’ portfolios at the end of December. BHC investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. There were 30 hedge funds in our database with BHC positions at the end of the previous quarter. Our calculations also showed that BHC isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s view the recent hedge fund action encompassing Bausch Health Companies (NYSE:BHC).

Hedge fund activity in Bausch Health Companies (NYSE:BHC)

At the end of the fourth quarter, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in BHC a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Bausch Health Companies (NYSE:BHC) was held by Paulson & Co, which reported holding $384.9 million worth of stock at the end of September. It was followed by ValueAct Capital with a $333.1 million position. Other investors bullish on the company included Glenview Capital, GoldenTree Asset Management, and OrbiMed Advisors.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. AQR Capital Management, managed by Cliff Asness, initiated the most valuable position in Bausch Health Companies (NYSE:BHC). AQR Capital Management had $36.5 million invested in the company at the end of the quarter. Stephen DuBois’s Camber Capital Management also initiated a $18.5 million position during the quarter. The other funds with brand new BHC positions are Michael Gelband’s ExodusPoint Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Clint Carlson’s Carlson Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Bausch Health Companies (NYSE:BHC) but similarly valued. These stocks are AMERCO (NASDAQ:UHAL), Unum Group (NYSE:UNM), KAR Auction Services Inc (NYSE:KAR), and Zillow Group Inc (NASDAQ:Z). This group of stocks’ market valuations resemble BHC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UHAL | 7 | 348384 | -1 |

| UNM | 25 | 291468 | 0 |

| KAR | 34 | 573718 | 6 |

| Z | 23 | 567162 | 1 |

| Average | 22.25 | 445183 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $445 million. That figure was $1348 million in BHC’s case. KAR Auction Services Inc (NYSE:KAR) is the most popular stock in this table. On the other hand AMERCO (NASDAQ:UHAL) is the least popular one with only 7 bullish hedge fund positions. Bausch Health Companies (NYSE:BHC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on BHC as the stock returned 39.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.