We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Exxon Mobil Corporation (NYSE:XOM).

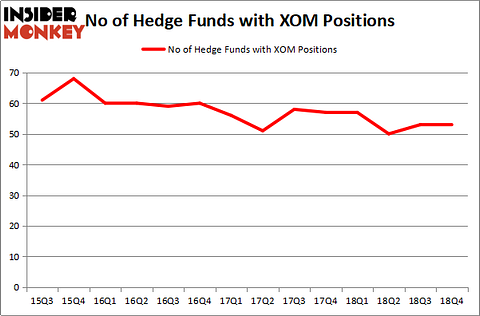

Exxon Mobil Corporation (NYSE:XOM) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 53 hedge funds’ portfolios at the end of December. At the end of this article we will also compare XOM to other stocks including Walmart Inc. (NYSE:WMT), Nestle SA (OTCMKTS:NSRGY), and Royal Dutch Shell plc (NYSE:RDS) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action encompassing Exxon Mobil Corporation (NYSE:XOM).

Hedge fund activity in Exxon Mobil Corporation (NYSE:XOM)

At the end of the fourth quarter, a total of 53 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 57 hedge funds with a bullish position in XOM a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ken Fisher’s Fisher Asset Management has the number one position in Exxon Mobil Corporation (NYSE:XOM), worth close to $404.5 million, comprising 0.6% of its total 13F portfolio. Coming in second is Richard S. Pzena of Pzena Investment Management, with a $316.1 million position; 1.8% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism comprise Cliff Asness’s AQR Capital Management, and Donald Yacktman’s Yacktman Asset Management.

Seeing as Exxon Mobil Corporation (NYSE:XOM) has faced falling interest from the smart money, it’s easy to see that there was a specific group of hedgies who sold off their entire stakes heading into Q3. Interestingly, Jim Simons’s Renaissance Technologies dumped the biggest stake of the “upper crust” of funds watched by Insider Monkey, worth an estimated $70.1 million in stock. Vince Maddi and Shawn Brennan’s fund, SIR Capital Management, also dumped its stock, about $22.3 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Exxon Mobil Corporation (NYSE:XOM). We will take a look at Walmart Inc. (NYSE:WMT), Nestle SA (OTCMKTS:NSRGY), Royal Dutch Shell plc (NYSE:RDS), and Pfizer Inc. (NYSE:PFE). All of these stocks’ market caps are similar to XOM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WMT | 63 | 4444246 | 3 |

| NSRGY | 4 | 1502328 | -1 |

| RDS | 33 | 1619869 | -3 |

| PFE | 59 | 4674754 | 1 |

| Average | 39.75 | 3060299 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.75 hedge funds with bullish positions and the average amount invested in these stocks was $3060 million. That figure was $1614 million in XOM’s case. Walmart Inc. (NYSE:WMT) is the most popular stock in this table. On the other hand Nestle SA (OTCMKTS:NSRGY) is the least popular one with only 4 bullish hedge fund positions. Exxon Mobil Corporation (NYSE:XOM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on XOM as the stock returned 18.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.