Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC).

Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) investors should pay attention to a decrease in hedge fund sentiment of late. Our calculations also showed that ERIC isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a peek at the fresh hedge fund action encompassing Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC).

How are hedge funds trading Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC)?

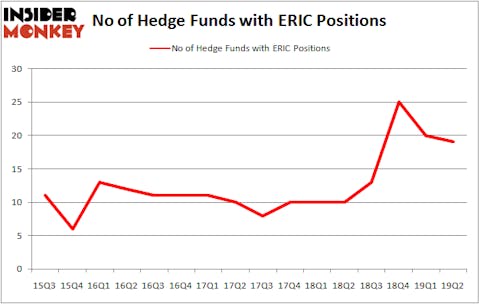

Heading into the third quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ERIC over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC), which was worth $221.9 million at the end of the second quarter. On the second spot was Arrowstreet Capital which amassed $79.5 million worth of shares. Moreover, Cavalry Asset Management, 13D Management, and Masters Capital Management were also bullish on Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC), allocating a large percentage of their portfolios to this stock.

Because Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) has witnessed declining sentiment from hedge fund managers, it’s easy to see that there exists a select few hedgies who were dropping their full holdings last quarter. At the top of the heap, Ken Fisher’s Fisher Asset Management dropped the largest position of all the hedgies monitored by Insider Monkey, worth an estimated $2 million in stock, and Mike Vranos’s Ellington was right behind this move, as the fund sold off about $0.6 million worth. These moves are interesting, as total hedge fund interest fell by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC). These stocks are Canon Inc. (NYSE:CAJ), Square, Inc. (NYSE:SQ), Shopify Inc (NYSE:SHOP), and Nutrien Ltd. (NYSE:NTR). This group of stocks’ market valuations resemble ERIC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAJ | 6 | 87599 | -1 |

| SQ | 53 | 2056333 | 3 |

| SHOP | 26 | 2201348 | 1 |

| NTR | 22 | 211755 | -3 |

| Average | 26.75 | 1139259 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $1139 million. That figure was $415 million in ERIC’s case. Square, Inc. (NYSE:SQ) is the most popular stock in this table. On the other hand Canon Inc. (NYSE:CAJ) is the least popular one with only 6 bullish hedge fund positions. Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ERIC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ERIC investors were disappointed as the stock returned -16% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.