Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Incyte Corporation (NASDAQ:INCY) in this article.

Is Incyte Corporation (NASDAQ:INCY) the right pick for your portfolio? Investors who are in the know are in a bearish mood. The number of long hedge fund positions decreased by 3 lately. Our calculations also showed that INCY isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the recent hedge fund action regarding Incyte Corporation (NASDAQ:INCY).

How have hedgies been trading Incyte Corporation (NASDAQ:INCY)?

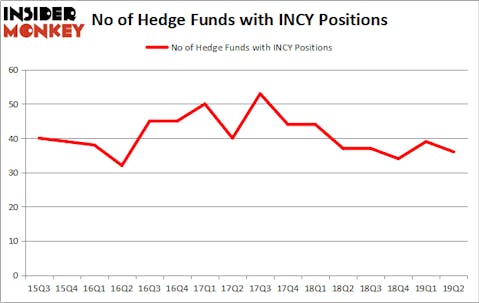

At Q2’s end, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards INCY over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Among these funds, Baker Bros. Advisors held the most valuable stake in Incyte Corporation (NASDAQ:INCY), which was worth $2716.7 million at the end of the second quarter. On the second spot was Matrix Capital Management which amassed $340.8 million worth of shares. Moreover, Renaissance Technologies, Two Sigma Advisors, and D E Shaw were also bullish on Incyte Corporation (NASDAQ:INCY), allocating a large percentage of their portfolios to this stock.

Due to the fact that Incyte Corporation (NASDAQ:INCY) has faced falling interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of hedge funds that elected to cut their full holdings last quarter. Intriguingly, Robert Pohly’s Samlyn Capital said goodbye to the largest investment of the “upper crust” of funds followed by Insider Monkey, valued at about $11.4 million in stock. Bruce Kovner’s fund, Caxton Associates LP, also cut its stock, about $8.6 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 3 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Incyte Corporation (NASDAQ:INCY) but similarly valued. We will take a look at HEICO Corporation (NYSE:HEI), Church & Dwight Co., Inc. (NYSE:CHD), Check Point Software Technologies Ltd. (NASDAQ:CHKP), and Kellogg Company (NYSE:K). This group of stocks’ market caps match INCY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HEI | 35 | 1099994 | 9 |

| CHD | 30 | 338517 | 6 |

| CHKP | 24 | 666653 | 0 |

| K | 28 | 528857 | 2 |

| Average | 29.25 | 658505 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $659 million. That figure was $3729 million in INCY’s case. HEICO Corporation (NYSE:HEI) is the most popular stock in this table. On the other hand Check Point Software Technologies Ltd. (NASDAQ:CHKP) is the least popular one with only 24 bullish hedge fund positions. Compared to these stocks Incyte Corporation (NASDAQ:INCY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately INCY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on INCY were disappointed as the stock returned -12.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.