We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 835 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2019. What do these smart investors think about Boston Scientific Corporation (NYSE:BSX)?

Boston Scientific Corporation (NYSE:BSX) shareholders have witnessed an increase in enthusiasm from smart money lately. Our calculations also showed that BSX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In today’s marketplace there are a multitude of methods shareholders put to use to assess stocks. A pair of the most under-the-radar methods are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top money managers can outclass their index-focused peers by a very impressive amount (see the details here).

Andreas Halvorsen of Viking Global

With all of this in mind we’re going to take a look at the key hedge fund action regarding Boston Scientific Corporation (NYSE:BSX).

What have hedge funds been doing with Boston Scientific Corporation (NYSE:BSX)?

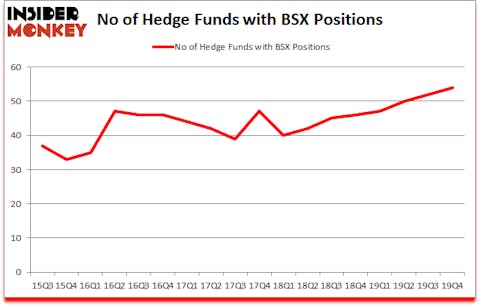

At the end of the fourth quarter, a total of 54 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in BSX over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Boston Scientific Corporation (NYSE:BSX) was held by Viking Global, which reported holding $836.2 million worth of stock at the end of September. It was followed by Marshall Wace LLP with a $369.5 million position. Other investors bullish on the company included Citadel Investment Group, Third Point, and OrbiMed Advisors. In terms of the portfolio weights assigned to each position Iron Triangle Partners allocated the biggest weight to Boston Scientific Corporation (NYSE:BSX), around 8.87% of its 13F portfolio. Highline Capital Management is also relatively very bullish on the stock, designating 7.4 percent of its 13F equity portfolio to BSX.

As industrywide interest jumped, key money managers were breaking ground themselves. Redmile Group, managed by Jeremy Green, created the most valuable position in Boston Scientific Corporation (NYSE:BSX). Redmile Group had $73.8 million invested in the company at the end of the quarter. Jacob Doft’s Highline Capital Management also initiated a $46.7 million position during the quarter. The following funds were also among the new BSX investors: Michael Rockefeller and Karl Kroeker’s Woodline Partners, Kevin Molloy’s Iron Triangle Partners, and Steve Cohen’s Point72 Asset Management.

Let’s now review hedge fund activity in other stocks similar to Boston Scientific Corporation (NYSE:BSX). We will take a look at Allergan plc (NYSE:AGN), VMware, Inc. (NYSE:VMW), Takeda Pharmaceutical Company Limited (NYSE:TAK), and Enterprise Products Partners L.P. (NYSE:EPD). This group of stocks’ market caps match BSX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AGN | 86 | 9927657 | 2 |

| VMW | 33 | 777041 | -4 |

| TAK | 28 | 1186486 | -3 |

| EPD | 28 | 340248 | 4 |

| Average | 43.75 | 3057858 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43.75 hedge funds with bullish positions and the average amount invested in these stocks was $3058 million. That figure was $3208 million in BSX’s case. Allergan plc (NYSE:AGN) is the most popular stock in this table. On the other hand Takeda Pharmaceutical Company Limited (NYSE:TAK) is the least popular one with only 28 bullish hedge fund positions. Boston Scientific Corporation (NYSE:BSX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. Unfortunately BSX wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on BSX were disappointed as the stock returned -20.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.