Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in stocks like BHP Billiton plc (ADR) (NYSE:BBL).

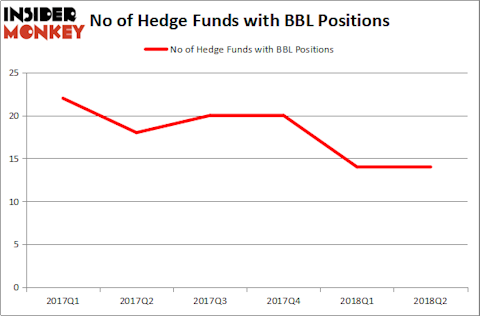

There wasn’t much activity happening in BHP Billiton plc (ADR) (NYSE:BBL) shares during Q2, as hedge fund ownership of the stock remained flat and was off by over 33% during the past five quarters. Hedge funds tracked by Insider Monkey’s database owned just 0.6% of the company’s shares on June 30. After the sale of its shale business is completed for $10.8 billion, BHP Billiton will award shareholders with a special $5.2 billion dividend. The miner ranked 5th on the list of 25 Dividend Stocks that Billionaire Ken Fisher is Bullish On.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

How are hedge funds trading BHP Billiton plc (ADR) (NYSE:BBL)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a unchanged from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in BBL in the middle of 2017. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Polaris Capital Management held the most valuable stake in BHP Billiton plc (ADR) (NYSE:BBL), which was worth $193.1 million at the end of the second quarter. On the second spot was Fisher Asset Management which amassed $186.2 million worth of shares. Moreover, Mason Capital Management, Sensato Capital Management, and LMR Partners were also bullish on BHP Billiton plc (ADR) (NYSE:BBL), allocating a large percentage of their portfolios to this stock.

Judging by the fact that BHP Billiton plc (ADR) (NYSE:BBL) has witnessed a decline in interest from the aggregate hedge fund industry, it’s easy to see that there is a sect of funds that decided to sell off their entire stakes heading into Q3. Intriguingly, Jonathan Barrett and Paul Segal’s Luminus Management dumped the biggest position of the 700 funds followed by Insider Monkey, valued at close to $9.4 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also said goodbye to its stock, about $4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as BHP Billiton plc (ADR) (NYSE:BBL) but similarly valued. We will take a look at Adobe Systems Incorporated (NASDAQ:ADBE), General Electric Company (NYSE:GE), 3M Co (NYSE:MMM), and Medtronic, Inc. (NYSE:MDT). This group of stocks’ market caps resemble BBL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADBE | 67 | 7026342 | 0 |

| GE | 44 | 3939699 | -3 |

| MMM | 33 | 463775 | -4 |

| MDT | 35 | 1697119 | -1 |

As you can see these stocks had an average of 45 hedge funds with bullish positions and the average amount invested in these stocks was $3.28 billion. That figure was $726 million in BBL’s case. Adobe Systems Incorporated (NASDAQ:ADBE) is the most popular stock in this table. On the other hand 3M Co (NYSE:MMM) is the least popular one with only 33 bullish hedge fund positions. Compared to these stocks BHP Billiton plc (ADR) (NYSE:BBL) is even less popular than MMM. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock.

Disclosure: None. This article was originally published at Insider Monkey.