We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the government. The 13F filings show the funds’ and investors’ portfolio positions as of June 30. In this article, we look at what those funds think of Eli Lilly & Co. (NYSE:LLY) based on that data.

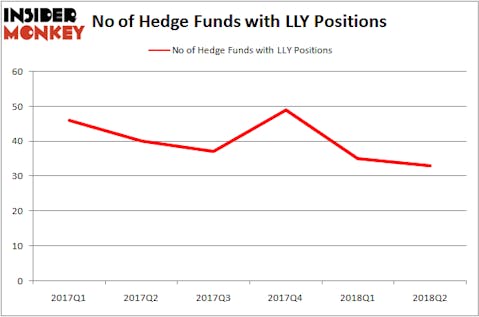

Eli Lilly & Co. (NYSE:LLY) experienced a drop in hedge fund ownership for the 4th time in the past 5 quarters during Q2. 33 hedge funds tracked in our database were long the stock on June 30, a greater than 30% drop since the beginning of the year. Eli Lilly & Co. (NYSE:LLY) just missed landing on our list of 25 Dividend Stocks that Billionaire Ken Fisher is Bullish On, as its 2.01% dividend yield wasn’t enough to qualify it for inclusion. Fisher Investments owned 3.73 million shares on September 30.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

How are hedge funds trading Eli Lilly & Co. (NYSE:LLY)?

Heading into the fourth quarter of 2018, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a 6% dip from the previous quarter. By comparison, 40 hedge funds held shares or bullish call options in LLY heading into the second-half of 2017. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ken Fisher’s Fisher Asset Management has the most valuable position in Eli Lilly & Co. (NYSE:LLY), worth close to $316.6 million, accounting for 0.4% of its total 13F portfolio. Sitting at the No. 2 spot is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $205.5 million position; 0.5% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish include Charles Lemonides’s Valueworks LLC, Krishen Sud’s Sivik Global Healthcare and Joe Huber’s Huber Capital Management.

Because Eli Lilly & Co. (NYSE:LLY) has experienced bearish sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few hedgies that slashed their entire stakes heading into Q3. Interestingly, George Hall’s Clinton Group sold off the biggest investment of all the hedgies watched by Insider Monkey, totaling about $7.2 million in stock, and Joel Greenblatt’s Gotham Asset Management was right behind this move, as the fund dumped about $7 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Eli Lilly & Co. (NYSE:LLY). We will take a look at Gilead Sciences, Inc. (NASDAQ:GILD), Costco Wholesale Corporation (NASDAQ:COST), United Parcel Service, Inc. (NYSE:UPS), and Twenty-First Century Fox Inc (NASDAQ:FOX). This group of stocks’ market caps resemble LLY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GILD | 57 | 3065919 | -7 |

| COST | 40 | 2400433 | 6 |

| UPS | 35 | 1618834 | 1 |

| FOX | 43 | 6472050 | 13 |

As you can see these stocks had an average of 44 hedge funds with bullish positions and the average amount invested in these stocks was $3.39 billion. That figure was $1.38 billion in LLY’s case. Gilead Sciences, Inc. (NASDAQ:GILD) is the most popular stock in this table. On the other hand United Parcel Service, Inc. (NYSE:UPS) is the least popular one with only 35 bullish hedge fund positions. Compared to these stocks Eli Lilly & Co. (NYSE:LLY) is even less popular than UPS. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock.

Disclosure: None. This article was originally published at Insider Monkey.