Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards HollyFrontier Corporation (NYSE:HFC).

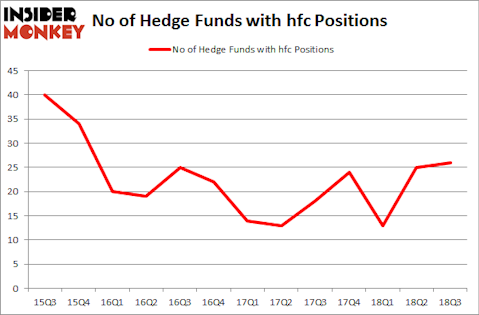

HollyFrontier Corporation (NYSE:HFC) was in 26 hedge funds’ portfolios at the end of September. HFC investors should pay attention to an increase in activity from the world’s largest hedge funds lately. There were 25 hedge funds in our database with HFC holdings at the end of the previous quarter. Our calculations also showed that hfc isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the key hedge fund action encompassing HollyFrontier Corporation (NYSE:HFC).

What have hedge funds been doing with HollyFrontier Corporation (NYSE:HFC)?

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the second quarter of 2018. On the other hand, there were a total of 24 hedge funds with a bullish position in HFC at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the biggest position in HollyFrontier Corporation (NYSE:HFC). AQR Capital Management has a $453.9 million position in the stock, comprising 0.5% of its 13F portfolio. The second largest stake is held by Millennium Management, led by Israel Englander, holding a $40 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism encompass Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, D. E. Shaw’s D E Shaw and Joel Greenblatt’s Gotham Asset Management.

Consequently, specific money managers were breaking ground themselves. Luminus Management, managed by Jonathan Barrett and Paul Segal, created the largest position in HollyFrontier Corporation (NYSE:HFC). Luminus Management had $9.6 million invested in the company at the end of the quarter. Rob Citrone’s Discovery Capital Management also initiated a $8.7 million position during the quarter. The other funds with brand new HFC positions are George Soros’s Soros Fund Management, Sara Nainzadeh’s Centenus Global Management, and Arvind Sanger’s GeoSphere Capital Management.

Let’s check out hedge fund activity in other stocks similar to HollyFrontier Corporation (NYSE:HFC). We will take a look at Seattle Genetics, Inc. (NASDAQ:SGEN), Teleflex Incorporated (NYSE:TFX), F5 Networks, Inc. (NASDAQ:FFIV), and Arch Capital Group Ltd. (NASDAQ:ACGL). This group of stocks’ market values match HFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SGEN | 15 | 4295030 | -3 |

| TFX | 17 | 728223 | -11 |

| FFIV | 24 | 919666 | -2 |

| ACGL | 17 | 1118780 | 1 |

| Average | 18.25 | 1765425 | -3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.77 billion. That figure was $628 million in HFC’s case. F5 Networks, Inc. (NASDAQ:FFIV) is the most popular stock in this table. On the other hand Seattle Genetics, Inc. (NASDAQ:SGEN) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks HollyFrontier Corporation (NYSE:HFC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.