In this article we will check out the progression of hedge fund sentiment towards Kilroy Realty Corp (NYSE:KRC) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

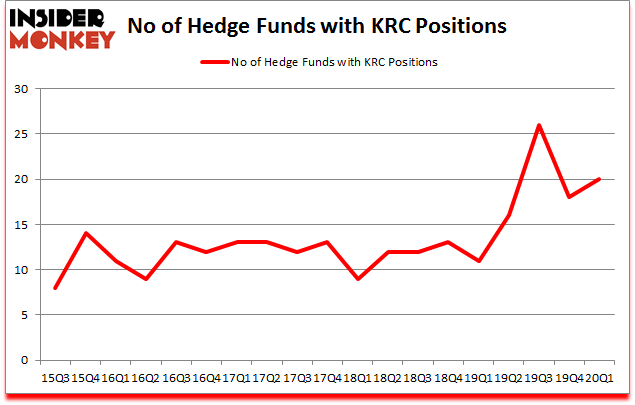

Is Kilroy Realty Corp (NYSE:KRC) a good investment now? Hedge funds are getting more bullish. The number of bullish hedge fund bets inched up by 2 in recent months. Our calculations also showed that KRC isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). KRC was in 20 hedge funds’ portfolios at the end of March. There were 18 hedge funds in our database with KRC positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are viewed as unimportant, outdated financial tools of the past. While there are greater than 8000 funds in operation at the moment, We hone in on the crème de la crème of this group, approximately 850 funds. These investment experts oversee the majority of the smart money’s total capital, and by following their top picks, Insider Monkey has brought to light various investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Daniel Sundheim of D1 Capital Partners

Keeping this in mind we’re going to take a glance at the fresh hedge fund action regarding Kilroy Realty Corp (NYSE:KRC).

Hedge fund activity in Kilroy Realty Corp (NYSE:KRC)

At the end of the first quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the previous quarter. By comparison, 11 hedge funds held shares or bullish call options in KRC a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Kilroy Realty Corp (NYSE:KRC) was held by Long Pond Capital, which reported holding $54 million worth of stock at the end of September. It was followed by Millennium Management with a $30.4 million position. Other investors bullish on the company included D1 Capital Partners, Owl Creek Asset Management, and Citadel Investment Group. In terms of the portfolio weights assigned to each position Hill Winds Capital allocated the biggest weight to Kilroy Realty Corp (NYSE:KRC), around 5.85% of its 13F portfolio. Pinz Capital is also relatively very bullish on the stock, dishing out 4.36 percent of its 13F equity portfolio to KRC.

Now, key hedge funds were leading the bulls’ herd. D1 Capital Partners, managed by Daniel Sundheim, established the most outsized position in Kilroy Realty Corp (NYSE:KRC). D1 Capital Partners had $24.7 million invested in the company at the end of the quarter. Jeffrey Altman’s Owl Creek Asset Management also initiated a $18.9 million position during the quarter. The other funds with brand new KRC positions are Eduardo Abush’s Waterfront Capital Partners, Matthew L Pinz’s Pinz Capital, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Kilroy Realty Corp (NYSE:KRC). These stocks are Hill-Rom Holdings, Inc. (NYSE:HRC), NovoCure Limited (NASDAQ:NVCR), Royal Caribbean Cruises Ltd. (NYSE:RCL), and Equitable Holdings, Inc. (NYSE:EQH). This group of stocks’ market caps are closest to KRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HRC | 30 | 738463 | 3 |

| NVCR | 27 | 371639 | 5 |

| RCL | 25 | 405608 | -18 |

| EQH | 27 | 821993 | -6 |

| Average | 27.25 | 584426 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $584 million. That figure was $181 million in KRC’s case. Hill-Rom Holdings, Inc. (NYSE:HRC) is the most popular stock in this table. On the other hand Royal Caribbean Cruises Ltd. (NYSE:RCL) is the least popular one with only 25 bullish hedge fund positions. Compared to these stocks Kilroy Realty Corp (NYSE:KRC) is even less popular than RCL. Hedge funds dodged a bullet by taking a bearish stance towards KRC. Our calculations showed that the top 10 most popular hedge fund stocks returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.2% in 2020 through June 17th but managed to beat the market by 14.8 percentage points. Unfortunately KRC wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was very bearish); KRC investors were disappointed as the stock returned 1.2% during the second quarter (through June 17th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Follow Kilroy Realty Corp (NYSE:NYSE: KRC)

Follow Kilroy Realty Corp (NYSE:NYSE: KRC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.