There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Kilroy Realty Corp (NYSE:KRC).

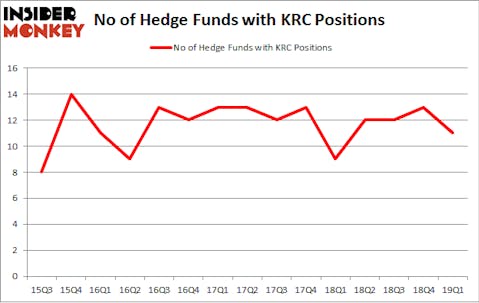

Kilroy Realty Corp (NYSE:KRC) has seen a decrease in activity from the world’s largest hedge funds in recent months. KRC was in 11 hedge funds’ portfolios at the end of March. There were 13 hedge funds in our database with KRC positions at the end of the previous quarter. Our calculations also showed that krc isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s analyze the fresh hedge fund action regarding Kilroy Realty Corp (NYSE:KRC).

What does smart money think about Kilroy Realty Corp (NYSE:KRC)?

Heading into the second quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards KRC over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Among these funds, Zimmer Partners held the most valuable stake in Kilroy Realty Corp (NYSE:KRC), which was worth $95 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $23.7 million worth of shares. Moreover, Adage Capital Management, Citadel Investment Group, and Springbok Capital were also bullish on Kilroy Realty Corp (NYSE:KRC), allocating a large percentage of their portfolios to this stock.

Seeing as Kilroy Realty Corp (NYSE:KRC) has experienced falling interest from the smart money, logic holds that there is a sect of money managers that slashed their entire stakes in the third quarter. It’s worth mentioning that D. E. Shaw’s D E Shaw dumped the largest stake of the 700 funds followed by Insider Monkey, totaling close to $16.6 million in stock, and John Khoury’s Long Pond Capital was right behind this move, as the fund cut about $11.3 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Kilroy Realty Corp (NYSE:KRC) but similarly valued. These stocks are Pentair plc (NYSE:PNR), RPM International Inc. (NYSE:RPM), US Foods Holding Corp. (NYSE:USFD), and Nordson Corporation (NASDAQ:NDSN). This group of stocks’ market caps are similar to KRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PNR | 28 | 675196 | 3 |

| RPM | 21 | 384411 | -2 |

| USFD | 40 | 1340524 | -1 |

| NDSN | 13 | 33215 | -6 |

| Average | 25.5 | 608337 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $608 million. That figure was $140 million in KRC’s case. US Foods Holding Corp. (NYSE:USFD) is the most popular stock in this table. On the other hand Nordson Corporation (NASDAQ:NDSN) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Kilroy Realty Corp (NYSE:KRC) is even less popular than NDSN. Hedge funds dodged a bullet by taking a bearish stance towards KRC. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately KRC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); KRC investors were disappointed as the stock returned 3.1% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.