Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 817 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Walmart Inc. (NYSE:WMT).

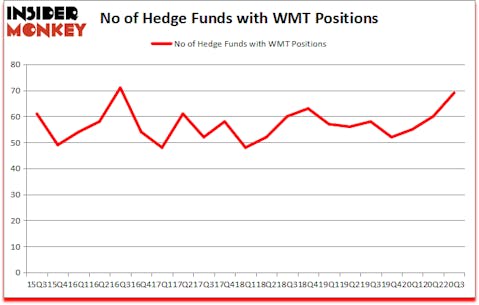

Is Walmart Inc. (NYSE:WMT) a good stock to buy now? The best stock pickers were getting more bullish. The number of long hedge fund positions rose by 9 lately. Walmart Inc. (NYSE:WMT) was in 69 hedge funds’ portfolios at the end of September. The all time high for this statistics is 71. Our calculations also showed that WMT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are viewed as unimportant, outdated financial vehicles of years past. While there are over 8000 funds in operation at present, Our researchers hone in on the masters of this group, around 850 funds. It is estimated that this group of investors control the majority of the hedge fund industry’s total asset base, and by tailing their matchless picks, Insider Monkey has formulated several investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Ray Dalio of Bridgewater Associates

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s check out the key hedge fund action surrounding Walmart Inc. (NYSE:WMT).

How have hedgies been trading Walmart Inc. (NYSE:WMT)?

At the end of the third quarter, a total of 69 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the second quarter of 2020. On the other hand, there were a total of 58 hedge funds with a bullish position in WMT a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Michael Larson’s Bill & Melinda Gates Foundation Trust has the biggest position in Walmart Inc. (NYSE:WMT), worth close to $1.6234 billion, amounting to 7.4% of its total 13F portfolio. The second largest stake is held by Fisher Asset Management, led by Ken Fisher, holding a $1.5855 billion position; the fund has 1.4% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish consist of Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management and Renaissance Technologies. In terms of the portfolio weights assigned to each position Empirical Capital Partners allocated the biggest weight to Walmart Inc. (NYSE:WMT), around 8.41% of its 13F portfolio. Pittencrieff Partners – Gabalex Capital is also relatively very bullish on the stock, setting aside 7.83 percent of its 13F equity portfolio to WMT.

As aggregate interest increased, some big names were leading the bulls’ herd. Bridgewater Associates, managed by Ray Dalio, established the largest position in Walmart Inc. (NYSE:WMT). Bridgewater Associates had $195.1 million invested in the company at the end of the quarter. Sahm Adrangi’s Kerrisdale Capital also initiated a $30.5 million position during the quarter. The other funds with brand new WMT positions are Bart Baum’s Ionic Capital Management, Steve Cohen’s Point72 Asset Management, and Chen Tianqiao’s Shanda Asset Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Walmart Inc. (NYSE:WMT) but similarly valued. These stocks are Johnson & Johnson (NYSE:JNJ), The Procter & Gamble Company (NYSE:PG), Mastercard Incorporated (NYSE:MA), NVIDIA Corporation (NASDAQ:NVDA), The Home Depot, Inc. (NYSE:HD), UnitedHealth Group Inc. (NYSE:UNH), and JPMorgan Chase & Co. (NYSE:JPM). All of these stocks’ market caps are similar to WMT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JNJ | 82 | 4882436 | -12 |

| PG | 75 | 10091350 | 2 |

| MA | 133 | 15645517 | -14 |

| NVDA | 82 | 7672045 | -10 |

| HD | 73 | 4957355 | -12 |

| UNH | 89 | 8963458 | -7 |

| JPM | 118 | 6058434 | -5 |

| Average | 93.1 | 8324371 | -8.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 93.1 hedge funds with bullish positions and the average amount invested in these stocks was $8324 million. That figure was $5493 million in WMT’s case. Mastercard Incorporated (NYSE:MA) is the most popular stock in this table. On the other hand The Home Depot, Inc. (NYSE:HD) is the least popular one with only 73 bullish hedge fund positions. Compared to these stocks Walmart Inc. (NYSE:WMT) is even less popular than HD. Our overall hedge fund sentiment score for WMT is 39.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Hedge funds dodged a bullet by taking a bearish stance towards WMT. Our calculations showed that the top 20 most popular hedge fund stocks returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through November 27th but managed to beat the market again by 16.1 percentage points. Unfortunately WMT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); WMT investors were disappointed as the stock returned 8.4% since the end of the third quarter (through 11/27) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Follow Walmart Inc. (NYSE:WMT)

Follow Walmart Inc. (NYSE:WMT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.