In this article we are going to use hedge fund sentiment as a tool and determine whether Walmart Inc. (NYSE:WMT) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

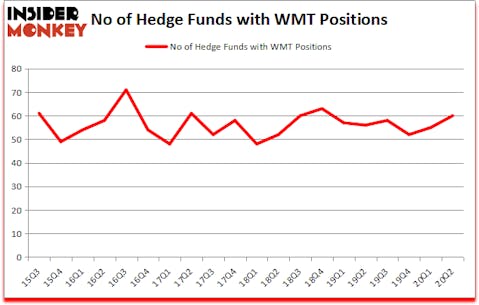

Walmart Inc. (NYSE:WMT) investors should pay attention to an increase in hedge fund sentiment of late. Walmart Inc. (NYSE:WMT) was in 60 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 71. There were 55 hedge funds in our database with WMT positions at the end of the first quarter. Our calculations also showed that WMT isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to check out the latest hedge fund action encompassing Walmart Inc. (NYSE:WMT).

What does smart money think about Walmart Inc. (NYSE:WMT)?

Heading into the third quarter of 2020, a total of 60 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from one quarter earlier. By comparison, 56 hedge funds held shares or bullish call options in WMT a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Michael Larson’s Bill & Melinda Gates Foundation Trust has the most valuable position in Walmart Inc. (NYSE:WMT), worth close to $1.3898 billion, accounting for 7.8% of its total 13F portfolio. Sitting at the No. 2 spot is Fisher Asset Management, managed by Ken Fisher, which holds a $1.3227 billion position; 1.3% of its 13F portfolio is allocated to the company. Other peers that hold long positions comprise Renaissance Technologies, Rajiv Jain’s GQG Partners and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position Leonard Green & Partners allocated the biggest weight to Walmart Inc. (NYSE:WMT), around 11.17% of its 13F portfolio. Crake Asset Management is also relatively very bullish on the stock, dishing out 9.78 percent of its 13F equity portfolio to WMT.

As one would reasonably expect, key money managers were breaking ground themselves. GQG Partners, managed by Rajiv Jain, established the most valuable position in Walmart Inc. (NYSE:WMT). GQG Partners had $417.1 million invested in the company at the end of the quarter. Martin Taylor’s Crake Asset Management also initiated a $99.8 million position during the quarter. The other funds with brand new WMT positions are Bo Shan’s Gobi Capital, Gregg Moskowitz’s Interval Partners, and Seth Wunder’s Black-and-White Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Walmart Inc. (NYSE:WMT) but similarly valued. We will take a look at Mastercard Incorporated (NYSE:MA), The Procter & Gamble Company (NYSE:PG), Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM), JPMorgan Chase & Co. (NYSE:JPM), UnitedHealth Group Inc. (NYSE:UNH), The Home Depot, Inc. (NYSE:HD), and Intel Corporation (NASDAQ:INTC). This group of stocks’ market valuations match WMT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MA | 147 | 14350337 | 8 |

| PG | 73 | 9244143 | -4 |

| TSM | 58 | 5209772 | 4 |

| JPM | 123 | 8732467 | 11 |

| UNH | 96 | 8326373 | -8 |

| HD | 85 | 4642557 | -2 |

| INTC | 78 | 6480425 | 5 |

| Average | 94.3 | 8140868 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 94.3 hedge funds with bullish positions and the average amount invested in these stocks was $8141 million. That figure was $5829 million in WMT’s case. Mastercard Incorporated (NYSE:MA) is the most popular stock in this table. On the other hand Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) is the least popular one with only 58 bullish hedge fund positions. Walmart Inc. (NYSE:WMT) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for WMT is 36.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 29.2% in 2020 through October 16th and still beat the market by 19.7 percentage points. A small number of hedge funds were also right about betting on WMT as the stock returned 21.3% since the end of the second quarter (through 10/16) and outperformed the market by an even larger margin.

Follow Walmart Inc. (NYSE:WMT)

Follow Walmart Inc. (NYSE:WMT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.