Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and investors’ positions as of the end of the fourth quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) based on that data.

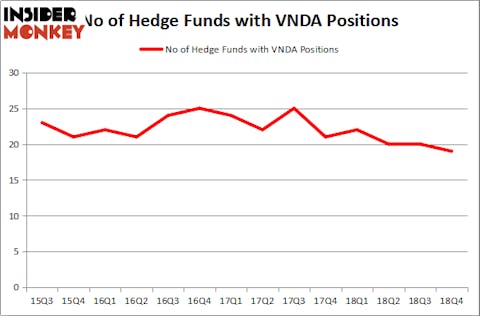

Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) was in 19 hedge funds’ portfolios at the end of December. VNDA shareholders have witnessed a decrease in hedge fund interest of late. There were 20 hedge funds in our database with VNDA holdings at the end of the previous quarter. Our calculations also showed that VNDA isn’t among the 30 most popular stocks among hedge funds.

At the moment there are plenty of gauges stock traders use to value stocks. A pair of the less utilized gauges are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best hedge fund managers can outperform the S&P 500 by a solid margin (see the details here).

We’re going to check out the new hedge fund action regarding Vanda Pharmaceuticals Inc. (NASDAQ:VNDA).

Hedge fund activity in Vanda Pharmaceuticals Inc. (NASDAQ:VNDA)

At the end of the fourth quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VNDA over the last 14 quarters. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) was held by Consonance Capital Management, which reported holding $121.7 million worth of stock at the end of December. It was followed by Palo Alto Investors with a $108.6 million position. Other investors bullish on the company included Renaissance Technologies, Adage Capital Management, and Millennium Management.

Seeing as Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) has faced falling interest from the entirety of the hedge funds we track, logic holds that there exists a select few funds that elected to cut their entire stakes in the third quarter. It’s worth mentioning that Steven Boyd’s Armistice Capital said goodbye to the largest investment of the 700 funds monitored by Insider Monkey, worth an estimated $20.7 million in stock. Behzad Aghazadeh’s fund, venBio Select Advisor, also cut its stock, about $9.9 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 1 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) but similarly valued. These stocks are Fresh Del Monte Produce Inc (NYSE:FDP), Matson, Inc. (NYSE:MATX), Kulicke and Soffa Industries Inc. (NASDAQ:KLIC), and Shutterfly, Inc. (NASDAQ:SFLY). This group of stocks’ market caps match VNDA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FDP | 15 | 42866 | 1 |

| MATX | 12 | 17426 | 3 |

| KLIC | 19 | 243689 | -3 |

| SFLY | 22 | 367739 | -1 |

| Average | 17 | 167930 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $168 million. That figure was $377 million in VNDA’s case. Shutterfly, Inc. (NASDAQ:SFLY) is the most popular stock in this table. On the other hand Matson, Inc. (NYSE:MATX) is the least popular one with only 12 bullish hedge fund positions. Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately VNDA wasn’t nearly as popular as these 15 stock and hedge funds that were betting on VNDA were disappointed as the stock returned -35.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.