Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in T-Mobile US, Inc. (NYSE:TMUS)? The smart money sentiment can provide an answer to this question.

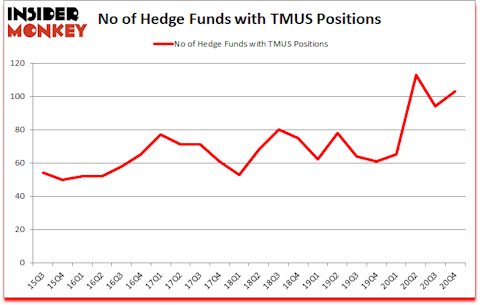

Is TMUS stock a buy or sell? T-Mobile US, Inc. (NYSE:TMUS) shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. T-Mobile US, Inc. (NYSE:TMUS) was in 103 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 113. Our calculations also showed that TMUS ranked 20th among the 30 most popular stocks among hedge funds (click for Q4 rankings).

John Armitage of Egerton Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. Recently Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best biotech stocks to invest in to pick the next stock that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). Now we’re going to check out the recent hedge fund action surrounding T-Mobile US, Inc. (NYSE:TMUS).

Do Hedge Funds Think TMUS Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 103 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TMUS over the last 22 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Andreas Halvorsen’s Viking Global has the most valuable position in T-Mobile US, Inc. (NYSE:TMUS), worth close to $1.1739 billion, corresponding to 3.2% of its total 13F portfolio. Sitting at the No. 2 spot is John Armitage of Egerton Capital Limited, with a $1.002 billion position; the fund has 5.7% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions comprise Warren Buffett’s Berkshire Hathaway, David Tepper’s Appaloosa Management LP and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position BlueDrive Global Investors allocated the biggest weight to T-Mobile US, Inc. (NYSE:TMUS), around 16.57% of its 13F portfolio. Fernbridge Capital Management is also relatively very bullish on the stock, earmarking 15.62 percent of its 13F equity portfolio to TMUS.

Consequently, specific money managers have been driving this bullishness. Fernbridge Capital Management, managed by Brennan Diaz, assembled the biggest position in T-Mobile US, Inc. (NYSE:TMUS). Fernbridge Capital Management had $94.1 million invested in the company at the end of the quarter. Gaurav Kapadia’s XN Exponent Advisors also made a $39 million investment in the stock during the quarter. The following funds were also among the new TMUS investors: John Brennan’s Sirios Capital Management, Felix Wai’s Zeno Research, and Kevin Cottrell and Chris LaSusa’s KCL Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as T-Mobile US, Inc. (NYSE:TMUS) but similarly valued. These stocks are Costco Wholesale Corporation (NASDAQ:COST), BHP Group (NYSE:BHP), Novo Nordisk A/S (NYSE:NVO), Chevron Corporation (NYSE:CVX), Eli Lilly and Company (NYSE:LLY), McDonald’s Corporation (NYSE:MCD), and The Unilever Group (NYSE:UL). This group of stocks’ market valuations resemble TMUS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COST | 61 | 3613961 | -12 |

| BHP | 20 | 1099946 | 2 |

| NVO | 23 | 3161939 | 1 |

| CVX | 50 | 5390278 | 7 |

| LLY | 50 | 3028302 | -10 |

| MCD | 62 | 2889876 | -3 |

| UL | 25 | 1172892 | 12 |

| Average | 41.6 | 2908171 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.6 hedge funds with bullish positions and the average amount invested in these stocks was $2908 million. That figure was $9117 million in TMUS’s case. McDonald’s Corporation (NYSE:MCD) is the most popular stock in this table. On the other hand BHP Group (NYSE:BHP) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks T-Mobile US, Inc. (NYSE:TMUS) is more popular among hedge funds. Our overall hedge fund sentiment score for TMUS is 87.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Unfortunately TMUS wasn’t nearly as successful as these 30 stocks and hedge funds that were betting on TMUS were disappointed as the stock returned -7.9% since the end of the fourth quarter (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the more diversified list of the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow T-Mobile Us Inc. (NASDAQ:TMUS)

Follow T-Mobile Us Inc. (NASDAQ:TMUS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.