Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the 12-month period ending October 30. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 30 stock picks outperformed the S&P 500 Index by 4 percentage points through the middle of November. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

Occidental Petroleum Corporation (NYSE:OXY) has experienced a decrease in support from the world’s most elite money managers lately. Our calculations also showed that OXY isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the new hedge fund action regarding Occidental Petroleum Corporation (NYSE:OXY).

Hedge fund activity in Occidental Petroleum Corporation (NYSE:OXY)

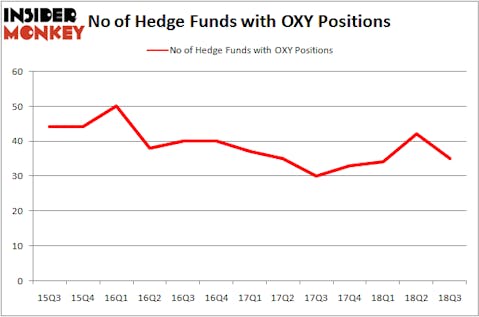

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -17% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards OXY over the last 13 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, John Overdeck and David Siegel’s Two Sigma Advisors has the biggest position in Occidental Petroleum Corporation (NYSE:OXY), worth close to $325.5 million, corresponding to 0.8% of its total 13F portfolio. The second largest stake is held by Levin Capital Strategies, led by John A. Levin, holding a $276.5 million position; the fund has 4.8% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish include D. E. Shaw’s D E Shaw, Cliff Asness’s AQR Capital Management and Ken Griffin’s Citadel Investment Group.

Because Occidental Petroleum Corporation (NYSE:OXY) has faced declining sentiment from hedge fund managers, it’s safe to say that there was a specific group of money managers that slashed their positions entirely last quarter. Intriguingly, Anand Parekh’s Alyeska Investment Group cut the largest position of the “upper crust” of funds followed by Insider Monkey, totaling an estimated $76.3 million in stock, and Christopher A. Winham’s Tide Point Capital was right behind this move, as the fund dropped about $64 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 7 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Occidental Petroleum Corporation (NYSE:OXY). We will take a look at Suncor Energy Inc. (NYSE:SU), Enterprise Products Partners L.P. (NYSE:EPD), Chubb Limited (NYSE:CB), and Relx PLC (NYSE:RELX). This group of stocks’ market caps are closest to OXY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SU | 36 | 1013082 | 10 |

| EPD | 22 | 333199 | 0 |

| CB | 30 | 526955 | 7 |

| RELX | 5 | 114083 | -1 |

| Average | 23.25 | 496830 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $497 million. That figure was $1.39 billion in OXY’s case. Suncor Energy Inc. (NYSE:SU) is the most popular stock in this table. On the other hand Relx PLC (NYSE:RELX) is the least popular one with only 5 bullish hedge fund positions. Occidental Petroleum Corporation (NYSE:OXY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.