Is Neptune Wellness Solutions Inc. (NASDAQ:NEPT) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

Neptune Wellness Solutions Inc. (NASDAQ:NEPT) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 8 hedge funds’ portfolios at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Tuscan Holdings Corp. (NASDAQ:THCB), ProQR Therapeutics NV (NASDAQ:PRQR), and Timkensteel Corp (NYSE:TMST) to gather more data points. Our calculations also showed that NEPT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s review the fresh hedge fund action encompassing Neptune Wellness Solutions Inc. (NASDAQ:NEPT).

Hedge fund activity in Neptune Wellness Solutions Inc. (NASDAQ:NEPT)

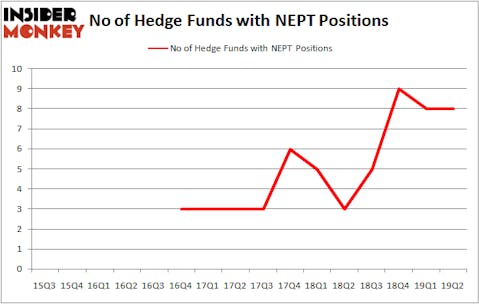

At Q2’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NEPT over the last 16 quarters. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Perceptive Advisors, managed by Joseph Edelman, holds the biggest position in Neptune Wellness Solutions Inc. (NASDAQ:NEPT). Perceptive Advisors has a $30 million position in the stock, comprising 0.7% of its 13F portfolio. The second most bullish fund is OZ Management, with a $1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other peers with similar optimism consist of William Harnisch’s Peconic Partners LLC, and John Overdeck and David Siegel’s Two Sigma Advisors.

Since Neptune Wellness Solutions Inc. (NASDAQ:NEPT) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there were a few funds that slashed their full holdings last quarter. It’s worth mentioning that Dmitry Balyasny’s Balyasny Asset Management dropped the largest position of all the hedgies monitored by Insider Monkey, totaling close to $0.5 million in stock. Ken Fisher’s fund, Fisher Asset Management, also dropped its stock, about $0.1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Neptune Wellness Solutions Inc. (NASDAQ:NEPT). We will take a look at Tuscan Holdings Corp. (NASDAQ:THCB), ProQR Therapeutics NV (NASDAQ:PRQR), Timkensteel Corp (NYSE:TMST), and Syros Pharmaceuticals, Inc. (NASDAQ:SYRS). All of these stocks’ market caps are similar to NEPT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THCB | 12 | 58263 | 4 |

| PRQR | 9 | 64723 | -1 |

| TMST | 16 | 54809 | 3 |

| SYRS | 13 | 83094 | 5 |

| Average | 12.5 | 65222 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $65 million. That figure was $32 million in NEPT’s case. Timkensteel Corp (NYSE:TMST) is the most popular stock in this table. On the other hand ProQR Therapeutics NV (NASDAQ:PRQR) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Neptune Wellness Solutions Inc. (NASDAQ:NEPT) is even less popular than PRQR. Hedge funds dodged a bullet by taking a bearish stance towards NEPT. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately NEPT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); NEPT investors were disappointed as the stock returned -18.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.