“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Hedge fund interest in Intellia Therapeutics, Inc. (NASDAQ:NTLA) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Heidrick & Struggles International, Inc. (NASDAQ:HSII), Ra Pharmaceuticals, Inc. (NASDAQ:RARX), and Rocket Pharmaceuticals, Inc. (NASDAQ:RCKT) to gather more data points.

According to most shareholders, hedge funds are seen as unimportant, outdated investment tools of years past. While there are over 8000 funds trading today, We hone in on the top tier of this club, around 750 funds. These hedge fund managers control the lion’s share of the smart money’s total capital, and by keeping an eye on their top picks, Insider Monkey has unearthed a number of investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s analyze the key hedge fund action regarding Intellia Therapeutics, Inc. (NASDAQ:NTLA).

How are hedge funds trading Intellia Therapeutics, Inc. (NASDAQ:NTLA)?

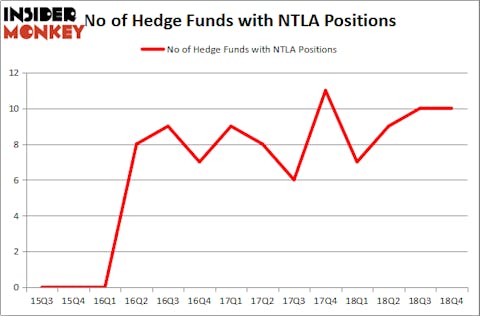

Heading into the first quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NTLA over the last 14 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, OrbiMed Advisors, managed by Samuel Isaly, holds the number one position in Intellia Therapeutics, Inc. (NASDAQ:NTLA). OrbiMed Advisors has a $5.2 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is Renaissance Technologies, led by Jim Simons, holding a $3.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism consist of Julian Baker and Felix Baker’s Baker Bros. Advisors, Kerr Neilson’s Platinum Asset Management and Peter Muller’s PDT Partners.

Judging by the fact that Intellia Therapeutics, Inc. (NASDAQ:NTLA) has experienced declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of hedgies that elected to cut their full holdings last quarter. It’s worth mentioning that Thomas Steyer’s Farallon Capital said goodbye to the biggest investment of the 700 funds followed by Insider Monkey, comprising about $15.7 million in stock. Noam Gottesman’s fund, GLG Partners, also said goodbye to its stock, about $0.9 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Intellia Therapeutics, Inc. (NASDAQ:NTLA) but similarly valued. We will take a look at Heidrick & Struggles International, Inc. (NASDAQ:HSII), Ra Pharmaceuticals, Inc. (NASDAQ:RARX), Rocket Pharmaceuticals, Inc. (NASDAQ:RCKT), and Exela Technologies, Inc. (NASDAQ:XELA). This group of stocks’ market caps resemble NTLA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HSII | 22 | 104567 | 3 |

| RARX | 17 | 159115 | 2 |

| RCKT | 14 | 176165 | -2 |

| XELA | 13 | 102031 | -1 |

| Average | 16.5 | 135470 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $135 million. That figure was $16 million in NTLA’s case. Heidrick & Struggles International, Inc. (NASDAQ:HSII) is the most popular stock in this table. On the other hand Exela Technologies, Inc. (NASDAQ:XELA) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Intellia Therapeutics, Inc. (NASDAQ:NTLA) is even less popular than XELA. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on NTLA, though not to the same extent, as the stock returned 19% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.